Apr 8, 2024

Tesla Set to Recover Top Spot in Cathie Wood’s Flagship Fund

, Bloomberg News

(Bloomberg) -- Tesla Inc. is poised to recover its top position in Cathie Wood’s main fund as her firm buys the dip in shares of the electric-vehicle maker.

ARK Innovation ETF, an exchange-traded fund known as ARKK, bought more than 2.3 million shares of Elon Musk’s company since December, raising the total weight to about 9.6%, according to Ark’s daily trading data compiled by Bloomberg. That’s second only to the current top holding — Coinbase Global Inc.’s 9.86%.

Before the current buying spree, ARK ETFs had sold Tesla shares for three consecutive quarters. The purchases in recent months have taken the fund’s total stake in the company to more than six million shares. Most of that buying has been done via flagship ARK Innovation ETF and has come at a time when Wall Street’s outlook on the company is darkening rapidly.

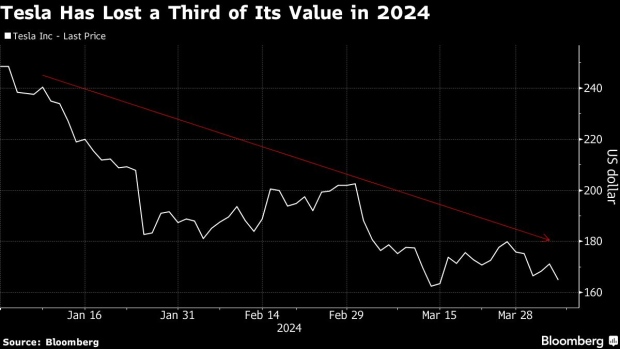

Tesla, which rose 4.2% in premarket trading on Monday, has erased about a third of its market value this year compared to a 9% gain in the S&P 500 Index and a 7.6% advance for the Nasdaq 100 Index. The stock extended its downtrend in April after the company said the number of cars it sold in the first quarter missed expectations by a wide margin, sparking concerns about its revenues and earnings growth.

The 12-month forward consensus profit estimate for Tesla has dropped about 30% over the past year compared to a rise of 11% in the same metric for the S&P 500 Index, according to data compiled by Bloomberg. The EV maker’s consensus analyst rating is near its lowest score in more than two-and-a-half years.

In a 2023 analysis, Ark estimated Tesla to reach $2,000 per share in 2027, with its bull and bear cases at $2,500 and $1,400 per share, respectively. It last closed below $167. Ark’s flagship fund has fallen 10% this year.

--With assistance from Subrat Patnaik.

(Updates with premarket stock move in paragraph four.)

©2024 Bloomberg L.P.