Apr 6, 2024

Pantera Capital Crypto Fund Posts 66% Gain Aided by Solana Token

, Bloomberg News

(Bloomberg) -- Pantera Capital’s roughly $300 million Liquid Token Fund finished the first quarter with a 66% return, helped by cryptocurrencies such as Solana amid reduced exposure to Bitcoin and Ethereum-linked tokens.

Gains in digital assets such as RBN, Aevo and STX also contributed to the performance in January through March, according to a shareholder letter seen by Bloomberg News.

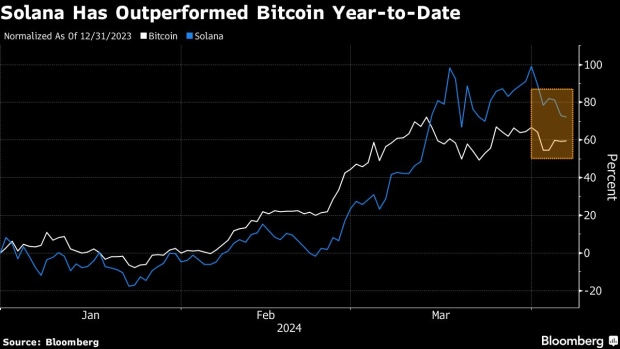

Bitcoin rose 67% in the first quarter, reaching a record $73,798 by mid-March before pulling back, while Solana almost doubled over the period. Bitcoin traded at $67,540 and Solana at $174 as of 10:40 a.m. Saturday in Singapore.

The Liquid Token Fund cut back investments in coins linked to the Ethereum blockchain, on headwinds such as reduced odds of US approval of spot-Ether exchange traded funds, the letter shows.

In an interview, portfolio manager Cosmo Jiang said the fund lowered Bitcoin holdings by more than half in the past three months. “We’d been pretty heavy in Bitcoin until the start of the year, and really like each month we’ve decreased that Bitcoin position meaningfully,” he said.

Bitcoin has quadrupled since the start of 2023, helped by the launch of US ETFs that directly hold the largest digital asset. The rally catalyzed risk appetite, spurring increases in smaller tokens as well as meme-crowd favorites like Dogecoin and dogwifhat.

The crypto rally has fizzled since the Bitcoin all-time peak as traders pared back wagers on monetary-policy loosening by the Federal Reserve.

Pantera Capital, a $5.2 billion asset manager, began investing in crypto in 2013 and offers a range of products. Bloomberg News reported in March that the company was raising money for a fund set up to buy up to $250 million of Solana — also known as SOL — from the FTX estate.

©2024 Bloomberg L.P.