Apr 9, 2024

Traders Turn Most Skeptical of EM Bond Rally Since 2013 Taper Tantrum

, Bloomberg News

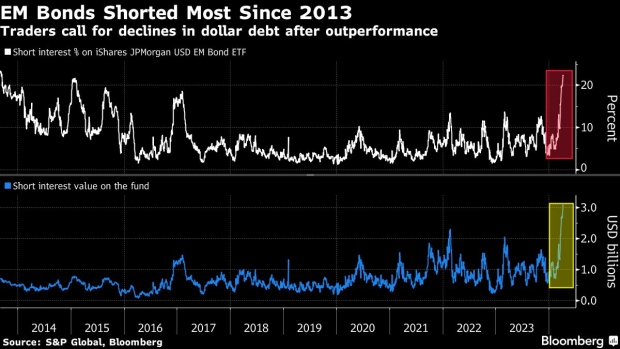

(Bloomberg) -- Short sellers are making the biggest bets against emerging-market dollar bonds in more than a decade on speculation that the recent rally has gone too far.

BlackRock Inc.’s iShares JPMorgan USD Emerging Markets Bond ETF, the biggest US exchange-traded fund investing in the securities, has seen a surge in bearish positions this year to 22%, or $3.1 billion, of the fund, according to data from S&P Global. That’s the most since the 2013 Taper Tantrum, when Federal Reserve’s plans to wind down quantitative easing sparked a panic selloff.

The spread on emerging-market bonds over US Treasuries is narrowing at the fastest annual pace since 2019 after some of the world’s most indebted nations — from Zambia to Sri Lanka — sewed up debt restructuring deals, and countries including Pakistan and Egypt received bilateral loans and IMF aid.

Investors are now questioning whether it has tightened too much amid uncertainties over Federal Reserve rate cuts and US economic data, said Anders Faergemann, a senior money manager at Pinebridge Investments, who is still optimistic over the longer-term outlook.

“We remain constructive on emerging markets due to improving fundamentals, yet we are conscious of the significant compression in HY spreads and how it influences short term valuations,” Faergemann said.

The average yield on emerging-market sovereign dollar bonds is unchanged so far this year at 7.65%, and that of corporate bonds has fallen 7 basis points. That shows resilience in the face of a spike in Treasury yields of 54 basis points on average since the start of 2024.

As a result, risk premiums are at multi-year lows. The extra yield investor demand to own EM bonds rather than Treasuries has narrowed to 331 basis points, the lowest since June 2021 and a whisker away from the March 2020 level, before the Covid pandemic sparked a flight of capital from emerging markets.

Now short sellers are signaling valuations have become too expensive. And with the most indebted nations out of distress, the potential for bargain hunting is also eroding.

What’s more, interest-rate hikes in countries such as Turkey and Egypt have made local-currency bonds more attractive than dollar securities.

©2024 Bloomberg L.P.