Mar 24, 2021

Michael Hakes' Top Picks: March 24, 2021

BNN Bloomberg

Full episode: Market Call for Wednesday, March 24, 2021

Michael Hakes, senior portfolio manager at the Murray Wealth Group

Focus: U.S. and global stocks

MARKET OUTLOOK:

The U.S. is on track to vaccinate 50 per cent of the population by May, with two million people per day receiving doses. This pace should increase. The “American Rescue Plan” of US$1.9 trillion passed and should bridge the gap as businesses open and employment comes back online. Total U.S. government support over COVID has been about US$5.2 trillion. To put this in perspective, European support is about US$4.2 trillion. The S&P 500 is outpacing the NASDAQ year-to-date as the market lens turns toward the ‘new normal’ with renewed focus on more mature business models and re-opening plays. Remember, the NASDAQ was up 44 per cent last year, easily outpacing the S&P500, up 16 per cent and the S&P/TSX up 2.1 per cent.

Of course, no recovery can take place without the constant worry about inflation and higher rates. Ten-Year Treasury rates are up about 50bp over the last month and are expected to rise to two per cent as the outlook improves. This is supportive of the more cyclical sectors such as banks, energy, auto and insurance. Longer term, we feel inflation will not be a problem and this will be supportive for equity markets overall.

Many of the “re-opening’ stocks have had huge moves up from the depths of despair one year ago but are still below prior prices that were reached in 2019/early 2020. These stocks are mainly in capital-intensive businesses like airlines, aerospace and cruise lines. We believe there is more upside in some of these as they begin to show investors that their business models are still intact.

In summary, we expect respectable market gains of five to 10 per cent this year. Our global growth fund has a healthy balance between leading growth stocks in communication services, technology, healthcare and some leading ‘re-opening’ companies.

TOP PICKS:

Airbus (AIR EPA)

Airbus is well positioned to benefit from air traffic recovery in 2021 and beyond. The sector has an oligopoly market structure with high barriers to entry. It’s still trading 30 per cent below pre-COVID highs. We would buy at EUR 85 or US$27.

This global leader in mobility and delivery is expected to become profitable in 2021. New initiatives such as Uber Pass and adding the 'last mile solution' could help upsize the market potential. We would buy at US$52.00.

BMW (BMW EPA)

With the auto sector on death row for the last several years, finally, some visibility on their electric vehicle strategies has given investors some reasons to be optimistic. BMW is about to rise again. We would buy at EUR $55 or US$20.50.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| AIR EPA | N | N | Y |

| UBER NASD | N | N | Y |

| BMW EPA | N | N | Y |

MID-SHOW CHAT:

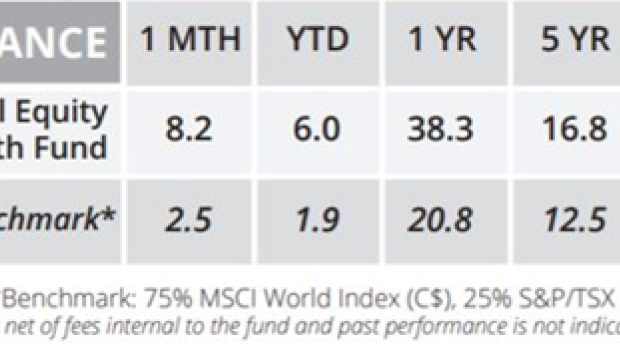

Our Global Equity Growth Fund has a solid five-year track record and gives investors a great way to get global equity exposure.

As of Feb 28th 2021: Inception June 30, 2015

Company website: https://murraywealthgroup.com/