Jul 11, 2022

Oil dragged lower by risk-off mood and rising China COVID cases

, Bloomberg News

I see oil prices going much higher: Chair Emeritus

Oil declined as a renewed increase in China’s virus cases fed into weakness across global markets and the US awarded more crude from its reserves.

West Texas Intermediate crude futures slipped to settle at US$104.09 a barrel. Earlier in the session, prices dropped as much as 3.9 per cent as COVID cases continued to climb in Shanghai, posing a challenge to the oil-consuming country’s COVID Zero strategy. On the supply side, concerns eased after a court order allowed the crucial CPC terminal on Russia’s Black Sea coast to stay operational. Meanwhile in the US, the Department of Energy awarded almost 39 million barrels of crude from the Strategic Petroleum Reserve to 14 companies.

“Crude is back under pressure as supply concerns from the CPC pipeline are eased and sentiment remains sour,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management.

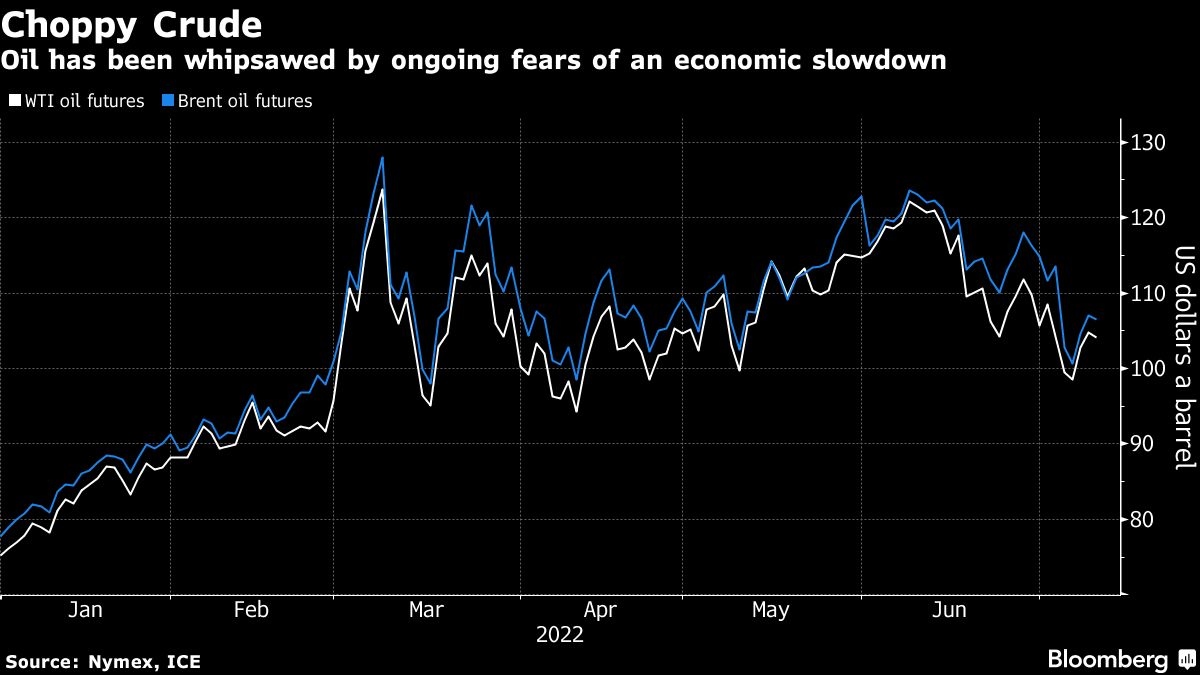

Oil dipped below US$100 last week, then rebounded as the market was whipsawed by competing supply and demand outlooks. US President Joe Biden is scheduled to visit Saudi Arabia in the coming days during a tour of the Middle East as he seeks to tame rising energy prices that are weighing on the global economy.

Speculators also turned more bearish on the main oil benchmarks last week. Money managers cut net-long positions in both Brent and WTI to the lowest level since 2020, according to data released Friday.

“CFTC data released Friday showed positioning was the least bullish in more than two years, highlighting the lack of conviction in holding commodity longs into an economic uncertainty,” Babin said.

There are some signs of relief for Biden. Gasoline prices -- a major contributor to inflation and a central issue in US elections -- have fallen for 27 days, including the single biggest daily drop in more than a decade. That’s the longest streak of declines since April 2020.

A court in the Krasnodar region on Monday canceled an instruction to suspend shipments from the CPC terminal on Russia’s Black Sea coast, which mainly exports Kazakh crude. It’s due to ship 1.2 million barrels a day this month.

Prices

- WTI for August delivery fell 70 cents to settle at US$104.09 a barrel in New York.

- Brent for September settlement rose 8 cents to settle at US$107.10 a barrel.

Shanghai recorded 69 new COVID infections Sunday, the most since late May. China will unveil a raft of economic data this week, with the numbers set to be scrutinized for evidence of COVID Zero’s impact on the world’s No. 2 economy.

Despite Chinese demand concerns, the oil market is still supported by tight supply, in part due to upended trade flows from Russia following its invasion of Ukraine. Time-spreads have firmed in a bullish backwardation structure, which indicates scarce volumes.