Dec 13, 2023

Oil rises as large U.S. stockpile drawdown gives bears pause

, Bloomberg News

Oil sentiment is at historic lows, 2024 will be a stock picker's market: Eric Nuttall

Oil rose as a drawdown in U.S. stockpiles helped thaw a market frozen by concerns about excess supplies.

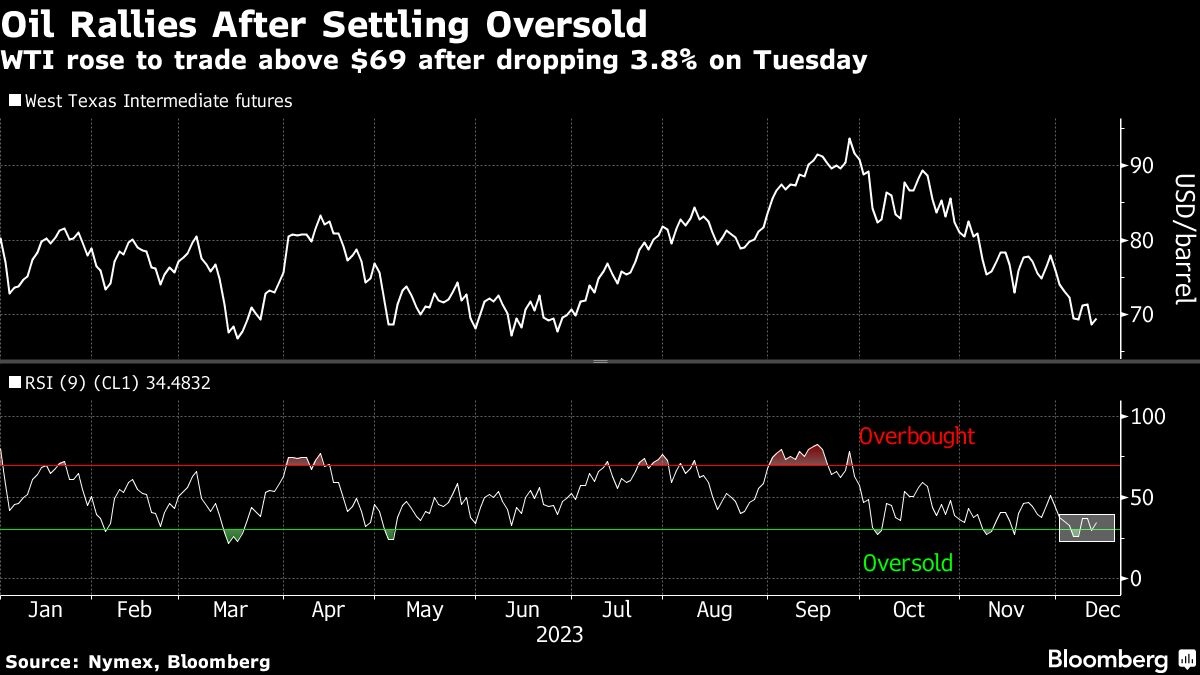

West Texas Intermediate rose 1.3 per cent to settle above US$69 in a relief rally catalyzed by overselling on Tuesday and a bullish oil inventory report Wednesday. U.S. crude stockpiles fell for a second week while total oil and product inventories declined by the most since October, the Energy Information Administration said. Thinning liquidity ahead of the holiday period has exacerbated price movements, with U.S. trading volumes below the 30-day average in three of the last four sessions.

“All and all, this is pretty bullish,” Rebecca Babin, a senior energy trader at CIBC Private Wealth, said of the inventory drawdowns. “Is it enough to spark a ‘true believers’ rally? No. But maybe gives shorts some pause on pressing further.”

Still, key market gauges continue signaling oversupply, with crude futures retreating 25 per cent since September. Nearby contracts are trading below later dated ones — a bearish structure known as contango — and some spreads are at the weakest since late 2020. The weekly average of Russia’s seaborne crude exports jumped to the highest level since early July, while the U.S. raised its estimate for 2023 output.

A move by OPEC and it allies to extend and deepen output cuts has failed to stem oil’s slide, with investors skeptical that the cartel will succeed in tightening the market. The Organization of Petroleum Exporting Countries, meanwhile, continues to forecast a significant shortfall in oil supplies next quarter, an outlook at odds with its own efforts to rein in production.

Prices:

- WTI for January delivery advanced 86 cents to settle at $69.47 a barrel in New York.

- Brent for February settlement rose $1.02 to settle at $74.26 a barrel.