Dec 6, 2023

Paytm Dives as Plan to Reduce Smaller Loans Seen Hitting Profit

, Bloomberg News

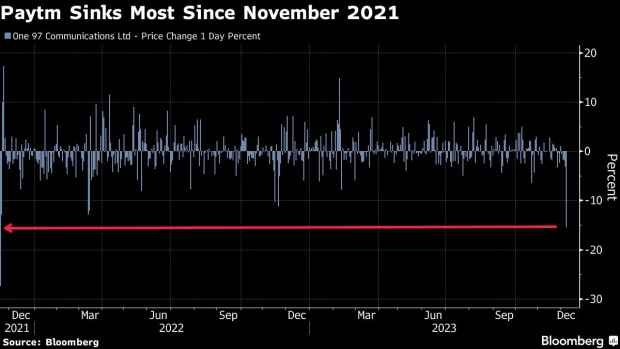

(Bloomberg) -- Paytm tumbled the most in two years after the fintech bellwether said it will reduce small-ticket size loans following the Indian central bank’s stricter rules to curb risky consumer lending.

Shares of the SoftBank Group Corp.-backed company, officially called One97 Communications Ltd., dropped 18.7% on Thursday. The slump, the steepest in more than two years, erased more than $1 billion in market value.

The Indian digital payments company said in a statement Wednesday that it will reduce disbursing of loans below 50,000 rupees ($600). That drew a flurry of rating downgrades from at least five brokers including Goldman Sachs Group Inc., JPMorgan Chase & Co. and Citigroup Inc., according to data compiled by Bloomberg.

Paytm’s action comes after the Reserve Bank of India in November asked lenders to boost provisions against personal loans and credit card borrowings as these debts are unsecured. Shares of India banks have since been under pressure as the central bank’s move is expected to hurt consumer spending — a key driver of the country’s economy — and in turn lenders’ profits.

According to the rules, banks will have to increase the risk cover on some consumer loans, credit card receivables and bank credit to shadow lenders by 25 percentage points. The increase in risk-weight of loans taken from banks may nudge non-bank lenders to seek alternative sources of credit, analysts have said.

A slowdown in smaller loans, a key channel for acquiring customers, “could affect medium-term growth potential” of Paytm’s other businesses as well, Citigroup analysts including Vijit Jain wrote in a note, downgrading the stock to neutral from buy. The broker also cut its estimates for Paytm’s operating profit by about 20% for fiscal year 2024 and 2025.

Nearly three quarters of Paytm’s Buy Now Pay Later loans in the second quarter were in the sub-50,000 rupees category, according to Citigroup.

The Reserve Bank of India Governor Shaktikanta Das has been urging banks to enhance internal controls as unsecured loans are growing nearly twice as fast as total lending. In October, he asked bankers to look carefully at their strategies, warning the surge in personal loans may heighten risks down the road.

Shares of Indian shadow lenders that partner with Paytm and others for smaller loans also slumped on Thursday. Aditya Birla Capital Ltd. fell 3.7%, the most in a month, while Bajaj Finance Ltd. slid more than 1%.

(Closes shares)

©2023 Bloomberg L.P.