Mar 13, 2024

Private-Credit Firms Lure Largest Latin American Asset Manager

, Bloomberg News

(Bloomberg) -- Vinci Partners Investments Ltd., the largest asset manager in Latin America, is looking to acquire private-credit firms to gain scale in a business that’s expanding globally.

“There is a gigantic opportunity for private credit in Latin America, a place where credit is still very much concentrated in the biggest banks,” Vinci Chief Executive Officer Alessandro Horta said in an interview. “We are just beginning to see disintermediation in the region,” where there is only a “small presence of big regional asset-management players.”

Since their initial public share offerings in January 2021, both Rio de Janeiro-based Vinci and its biggest competitor, Sao Paulo-based Patria Investments Ltd., have been on a buying spree, consolidating the alternative-investment industry in Latin America. Last week, Vinci said it will acquire Compass Group LLC to expand its footprint across the region, creating a combined entity that will manage more than $50 billion. In 2022, the company announced the acquisition of SPS Capital, a distressed-asset manager.

Vinci has about 5.4 billion reais ($1.1 billion) in private-credit funds in Brazil, and is planning to expand the business, including into other countries, Horta said.

“We are already an important player in this market of private credit, mainly on the high-grade side, but it’s just starting in Latin America,” he said. “The plan is to do high-yield and even distressed private credit.”

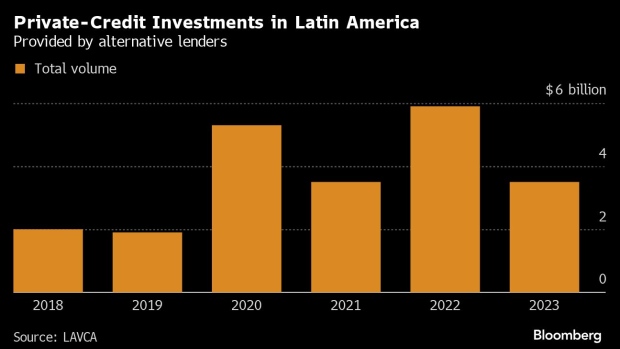

Globally, private credit is a $1.7 trillion industry. It took off after the 2008 financial crisis as an alternative to banks at a time when regulators were clamping down on risky lending by deposit-taking institutions. Higher interest rates helped fuel the boom, as high returns persuaded investors to lend directly to companies. In Latin America, deals from alternative lenders reached a record $5.9 billion in 2022, and then fell almost 40% to $3.55 billion in 2023, according to LAVCA, the Latin America association for private investments.

With net cash and investments of 1.3 billion reais in the fourth quarter, Vinci has money to buy smaller asset managers, Horta said. Other areas of interest would be smaller asset managers of infrastructure funds, he said.

Future acquisitions probably wouldn’t be as “transformational” as the Compass transaction, he said.

“We will pay mostly in shares, and Compass will have about 18% of Vinci and about $30 million in cash,” he said. In the future, depending on some metrics of performance, Compass could have an additional stake of 7.5%, he said.

The transaction, which is expected to be completed in the third quarter, will also place Compass founders Manuel Balbontin and Jaime de la Barra on Vinci’s board of directors.

Analysts at Itau BBA said the combined entity would have a market value of about $763 million, adding that the deal “looks accretive and strategically important.” Vinci has a market value of about $620 million.

Last October, an affiliate of Ares Management Corporation announced the private placement of $100 million in convertible preferred shares of Vinci with the formation of a strategic partnership to collaborate on product development and distribution, to help accelerate the growth of Vinci’s platform in Latin America. A month later, Ares reported that it would have a stake of about 15% in Vinci after the conversion.

Compass, founded in 1995, has a team of more than 300 people with operations in the US, the UK and seven Latin American countries, according to Horta. It serves pension funds in Mexico, Peru, Chile, Colombia, Argentina, Uruguay and Brazil. It also has an office in Miami to serve wealth clients. Vinci has an additional 300 employees.

Patria, now the second-biggest investment firm in Latin America, bought Chile’s Moneda Asset Management SA in 2021, and in October announced the acquisition of a $7.8 billion private equity unit from Abrdn Plc for £60 million ($76.2 million) in cash. In December, UBS Group AG said it agreed to sell Credit Suisse’s real estate fund-management business in Brazil to Patria for about 650 million reais.

Vinci, founded in 2009, spans businesses including private equity, real estate, private credit, infrastructure, hedge funds and special situations.

©2024 Bloomberg L.P.