Sep 12, 2022

Russia's Crude Oil Shipments Ride Out the Hit From Typhoon

, Bloomberg News

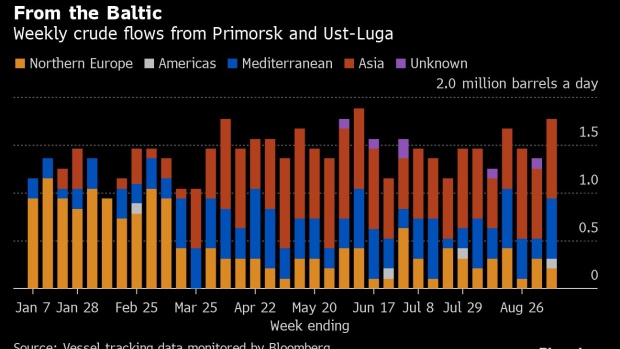

(Bloomberg) -- Even the remnants of a super typhoon that battered Russia’s primary export terminal on the Pacific Ocean could do little to disrupt the country’s seaborne crude flows. Storm Hinnamnor appeared to halt exports from Kozmino for part of the week to Sept. 9, with no ships leaving the terminal between Tuesday afternoon and Saturday afternoon. But flows ramped up quickly again once shipments resumed, while a surge in shipments from the Baltic offset lower volumes from Russia’s Black Sea and Arctic terminals. Total flows of Russian seaborne crude fell to 2.79 million barrels a day in the seven days to Sept. 9, a drop of almost 20% from a revised 3.42 million barrels a day the previous week. But, using a four-week moving average to smooth out variability in the figures, shipments nudged up to 3.11 million barrels a day in the four weeks to Sept. 9, up from a revised 3.08 million barrels a day in the period to Sept. 2.That may come as something of a relief to US officials who are keen to hit Russian oil revenues through a price cap, without reducing shipments.

Based on current destinations, the average flow of Russian crude to Asia in the four weeks to Sept. 9 fell to its lowest level since the period ending April 1, crimped by the storm.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export through Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since the invasion of Ukraine by Russia, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from European Union sanctions on Russia’s seaborne shipments that are due to come into effect in December.

Crude Flows by Destination:

-

Europe

Russia’s seaborne crude exports to European countries have stabilized just below 1 million barrels a day, down from more than 1.5 million barrels a day in the early months of 2022, before Russian troops invaded Ukraine in February.

Exports to Mediterranean countries jumped to their highest level this year in the four weeks to Sept. 9, driven by a surge in shipments to Turkey. Turkey took more Russian crude than any other country in the latest week, according to initial destination signals from ships leaving export terminals. With most of the crude on tankers signaling the Suez Canal as their destination likely to end up in India or China, the Mediterranean nation is unlikely to hold onto the top spot, but its imports of Russian crude will have come close to rivaling those of the two big Asian buyers.

The volume shipped from Russia to northern Europe fell back from its previous six-week high. Flows have averaged about 370,000 barrels a day since July, down from about 1.2 million barrels a day before the invasion of Ukraine.

Combined flows to Bulgaria and Romania slipped for a second week in the period to Sept. 9, but remain close to 200,000 barrels a day.

-

Asia

The volume of Russian crude on tankers showing destinations in Asia edged lower in the four weeks to Sept. 9, compared with the period ending Sept. 2. All of the tankers carrying crude to unidentified Asian destinations are signaling Port Said or the Suez Canal, with final discharge points unlikely to be apparent until they have passed through the waterway into the Red Sea, at the earliest.

Flows by Export Location

Aggregate flows of Russian crude fell by 630,000 barrels a day, or 18%, in the seven days to Sept. 9, compared with the previous week. Flows were lower from all export regions except the Baltic. Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty fell to a four-week low of $139 million in the seven days to Sept. 9.

Export duty rates for September are 2% lower than they were in August, due to a lower price realized for sales of its flagship Urals crude between mid-July and mid-August. The discount for Urals against Brent crude during that period narrowed to about $18.68 a barrel, down from a high of about $34.39 a barrel from mid-April to mid-May, according to Bloomberg calculations using figures published by the Russian Ministry of Finance.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 26 tankers loaded 19.6 million barrels of Russian crude in the week to Sept. 9, vessel-tracking data and port agent reports show. That’s down by 4.4 million barrels, reversing the previous week’s jump. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume of crude on ships loading Russian crude from Baltic terminals jumped to a 13-week high, with the most vessels this year departing Primorsk.

Shipments from Novorossiysk in the Black Sea fell back after the previous week’s surge.

Arctic shipments fell to their lowest level of the year, with just one vessel departing Murmansk in the week to Sept. 9.

Crude flows from Russia’s eastern oil terminals slumped to just 420,000 barrels a day. Shipments of ESPO crude from Kozmino were severely limited by the passage of Hinnamnor. Flows began to recover as the week ended. There were no shipments of Sokol or Sakhalin Blend crude.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures have been revised to exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }

©2022 Bloomberg L.P.