Mar 14, 2024

Russia’s Diesel Exports Explained as Drones Hit Oil Refineries

, Bloomberg News

(Bloomberg) -- Shipments of diesel from Russian ports have fallen in the weeks since drone strikes began on the nation’s oil refineries.

While there is evidence that the strikes are affecting the plants’ output, it will take time for any damage to refineries to fully feed into the country’s exports. Other factors, such as bad weather and routine maintenance, can also impact flows.

According to data compiled by Bloomberg from analytics firm Kpler, shipments in January — the month that the strikes began — were also exceptionally large, making a drop in February and early March look even bigger. Further muddying the waters, Moscow has also been meant to curb fuel shipments as part of its petroleum supply pact with OPEC+.

Russia typically exports about a million barrels-a-day of diesel-type fuel, making it one of the world’s top suppliers. Traders are closely monitoring the shipments as any sharp drop would exacerbate an already tight global supply picture.

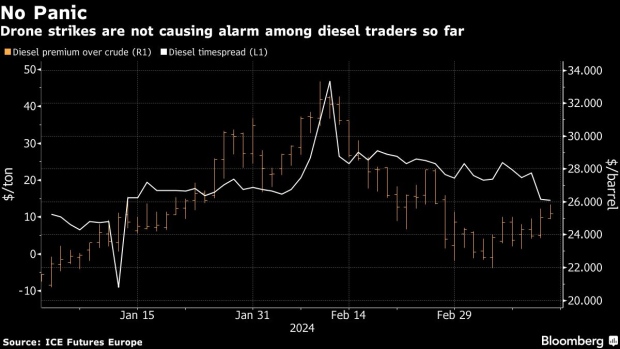

So far, diesel markets have remained relatively tranquil in response to the latest strikes. The fuel’s premium over crude stood at about $25 a barrel on Thursday afternoon in London, according to ICE Futures Europe data. That’s lower than where it was in late January.

Similarly, movements in the front timespread, another important indicator of traders’ perceptions of supply and demand, have shown little sign of a market in panic mode.

One trading house analyst raised the prospect of a potential Russian export ban — the country recently restricted gasoline shipments abroad — while a diesel trader highlighted attempts to strike Surgutneftegas PJSC’s Kinef refinery in Kirishi, on the Baltic coast, pointing out that the plant is a major exporter and any outage would have an immediate market impact.

Russia’s February exports of diesel-type fuel were down on a monthly basis and little changed from a year-earlier, Kpler data show. The drop has been more dramatic in the first two weeks of March, which show both an annual and monthly decline when comparing with full-month averages.

If March exports continue at their current rate, it will be the biggest monthly drop since September — the same month Russia temporarily banned exports. Such a fall also wouldn’t be entirely unexpected: Industry data seen by Bloomberg for the country’s key western ports showed diesel flows would drop by 11% this month.

READ: Russia Sees Lower Diesel Export by Sea in March After Drone Hits

There’s a lag of about 30-45 days between diesel being made in a refinery and it actually being loaded for export, said Viktor Katona, an analyst at Kpler. Russian refiners’ crude processing was down from both a month and year earlier in January and the first four weeks of February, weighing on production and likely fuel exports in following weeks.

Shipments from Russia’s main diesel exporting facility, the Baltic Sea port of Primorsk, also haven’t stopped despite the latest wave of attacks, according to data from Kpler and shipping information seen by Bloomberg.

Looking forward, the new lower levels of diesel-type fuel exports may persist given upcoming planned refinery work and the impact of drone strikes, Katona said.

--With assistance from Olga Tanas.

©2024 Bloomberg L.P.