Dec 3, 2023

Russian Gas Glut Shows Austria Still in Kremlin’s Energy Orbit

, Bloomberg News

(Bloomberg) -- Austria is overflowing with Russian natural gas, allowing the longtime customer of Gazprom PJSC to boost sales to its neighbors while delaying efforts to pivot from Kremlin-controlled energy.

The central European nation has been a hub for Russian flows for more than a half-century, with storage depots and pipelines historically configured to forward fuel to Hungary, Germany, Italy and Slovenia. State-owned OMV AG has a lengthy contract with Gazprom that obliges it to buy gas reaching the border.

The scrutiny of Austria’s supply is intensifying because the nation says it wants to diversify from Russia, yet trade data shows a steady flow via Ukraine that satisfies more than half the economy’s demand.

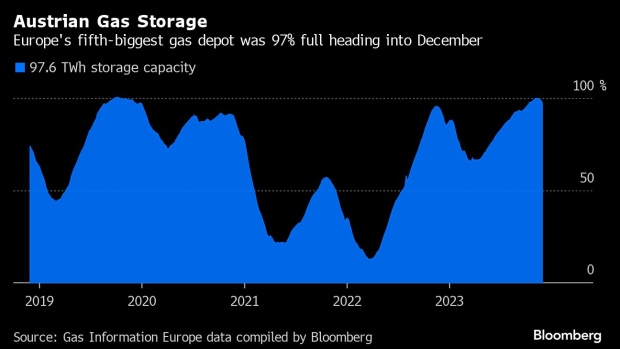

Overflowing storage depots and unimpeded shipments indicate the market is more comfortable after Russia’s February 2022 invasion of Ukraine, said Walter Boltz, a former Austrian regulator who’s now a senior energy adviser with Baker & Mckenzie LLP.

“Austria should be able to survive even a sudden disruption” of Ukraine flows this year, he said.

Still, Boltz said he’s increasingly alarmed by the failure to break free from Gazprom’s grip. He sees significant risk for disruptions once Ukraine’s gas-transit deal with Russia expires next year.

The Gazprom contract lasts until 2040. Despite the war, Gazprom has continued supplying OMV’s Baumgarten gas hub through pipelines that crisscross Ukraine.

But that transit arrangement will end in December 2024, with Kyiv’s government pledging not to negotiate a new pact with Russia.

While Ukraine has signaled it remains open to European traders arranging access on an individual basis, the persistent threat of war damage to pipelines or compressor stations means deliveries can’t be guaranteed.

Gas Connect Austria GmbH, which owns and operates the domestic east-west pipeline network, said it started expanding capacity to Germany. The WAG LOOP 1 may provide 27 terawatt-hours of gas — equivalent to about a third of annual demand — but won’t be ready for operation until 2027.

The operator still hasn’t applied for the environmental permits needed for the 40-kilometer (25-mile) pipeline extension. Regulators approved the proposal earlier this year, obliging Gas Connect Austria to finish the €200 million ($217 million) project.

Negotiations over new tariffs, combined with Austrian legal restrictions and the absences of financial commitments and long-term bookings, all weigh against accelerating the work, a Gas Connect Austria spokesperson said.

The Climate and Energy Ministry said it’s alarmed by that slow progress because the expansion is of central importance to securing gas flows. There is no reason to wait any longer, the ministry said in an email response to questions.

Boltz and Gas Connect Austria both said the country can cover demand in 2025 even without Russia supplies, but long-term price stability can only be achieved through new connections.

“The risk in 2025 and 2026 is not so much that there will be no gas available, but that prices could again be quite high,” Boltz said. “We need to avoid another price crisis.”

©2023 Bloomberg L.P.