Dec 13, 2023

Sell S&P 500 in ‘Every Scenario’ Looms as Rally Is Overheating

, Bloomberg News

(Bloomberg) -- Even a slight push back from the Federal Reserve on interest-rate cuts could unravel the relentless stock rally since late October.

Equity markets in Europe and the US look stretched on every front: flows, momentum and technical levels — leaving little headroom if the message from Chair Jerome Powell disappoints. With the S&P 500 just 3% short of a record and the Euro Stoxx 50 Index near its highest level since 2001, the stakes haven’t been this elevated before a Fed meeting since the rates pause in July.

A speedy switch from short-to-long equities by commodity trading advisers, who usually trade on market momentum, has been a major factor behind the $4.6 trillion rally in US stocks since Oct. 27. The shift has now left CTAs sitting on a $106 billion in long bets, which Goldman Sachs Group Inc. says leaves them more inclined to sell, rather than buy.

“We have this cohort modeled to sell S&P 500 in every scenario over the next week,” Goldman’s derivatives and flow specialist Cullen Morgan wrote in a note to clients. It follows a warning from his colleagues last week that dangerously high optimism on stocks means there are “no longer any bears left.”

Read more: ‘No Bears Left’ Is Worrying Refrain Coming From Wall Street

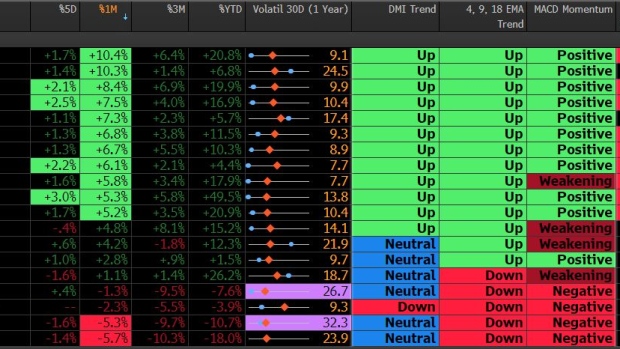

Trend and momentum indicators are still green for Europe and the US, while only Asian markets are showing some signs of weakening. What’s more, nine out of the 11 top performing benchmarks are now showing relative strength indicators in overbought territory, according to data compiled by Bloomberg.

Read more: Last Time Euro-Area Stocks Were This Overbought Was in 1999

No matter which way markets go, Goldman says CTAs are modeled to sell S&P 500 futures in the next week.

According to Morgan, if equities make an upward move, CTAs will have $20 billion worth of stocks to buy, but $1.3 billion in S&P 500 futures to sell. In a downward-move scenario, they would need to sell $5 billion of stocks and $1.9 billion of S&P 500 futures. Even in a flat market, while CTAs will need to buy $18 billion of global stocks, they would sell $436 million in S&P 500 futures.

A potential drop in markets could be further accelerated by other technical traders as the S&P 500 Index has just broken above its summer highs, with a failure by the gauge to move beyond that mark potentially seen as a signal for the first short-term corrective move since the rally started in late October.

The asymmetry in these flows comes at a point where policy makers could feel they need to rein in markets as bets on monetary easing and rate cuts build ever-higher expectations.

©2023 Bloomberg L.P.