Apr 13, 2022

Singapore’s MAS Tightens Policy Amid Global Inflation Fight

, Bloomberg News

(Bloomberg) -- Singapore’s central bank tightened monetary policy settings, furthering the global fight against inflation that threatens the recovery of consumer and business activity from the pandemic.

The Monetary Authority of Singapore, which manages the exchange rate of the local dollar as its main policy tool, raised the slope and re-centered its policy band higher, it said in a statement Thursday. The moves are the first time since April 2010 that the MAS tightened policy by using both tools at the same time.

Follow the Singapore Monetary Policy Decision on TOPLive

Coming after a surprise tightening in January, Thursday’s decision is seen helping insulate the trade-reliant economy from Russia’s war-induced supply disruptions. That would be achieved by allowing the local dollar to appreciate, buffering the impact of imported inflation.

“This tighter monetary policy stance, which builds on the policy moves in October 2021 and January 2022, will slow the inflation momentum and help ensure medium-term price stability,” it said in the statement.

Singapore has been on the forefront of central banks in Asia acting to combat rising price pressures. While many global peers led by the U.S. Federal Reserve began tightening earlier this year, most Asian policymakers, particularly outside China and Japan, have just begun pivoting away from supporting post-pandemic recoveries toward fighting inflation.

Read more: Inflation Wave Reaches Asia With Signs Worst Is Yet to Come

Core inflation, which strips out costs of private transport and accommodation, probably will rise 2.5%-3.5% in 2022 compared with the MAS January forecast for 2%-3%. All-items inflation in 2022 likely will be 4.5%-5.5%, versus earlier expectations of 2.5%-3.5%.

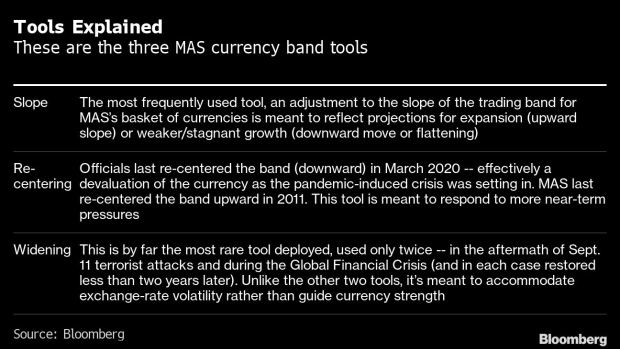

The MAS has a unique approach to monetary policy. Rather than using interest rates to maintain price stability, it guides the local dollar within a policy band against a trade-weighted basket of currencies.

Read more: A Central Bank With No Key Rate? Yes, in Singapore: QuickTake

Policy is set by adjusting the slope, or pace of appreciation, as well as the width and center of the currency band. Since the outset of the pandemic until October’s tightening, it had set the slope at 0%, implying that it wasn’t seeking currency appreciation.

The monetary policy statement was announced at the same time as the government’s advance reading of first-quarter gross domestic product. The economy during January-March grew 3.4% from the same period a year ago, compared with a median estimate in a Bloomberg survey for a 3.8% expansion.

Singapore has seen relatively brighter growth prospects than neighboring countries in Southeast Asia, particularly as recent loosening of Covid-era mobility restrictions has breathed fresh life into the battered food and beverage and hospitality sectors. The lifting of the city-state’s outdoor mask requirement, resumption of nightlife and relaxation of travel policies have buoyed expectations that the trade-reliant city-state can lead regional economies in treating Covid as endemic.

First-quarter GDP details, year-on-year, include:

- Manufacturing +6%, after +15.5% in the previous quarter

- Construction +1.8%, after +2.9%

- Services industries +3.9%, after +4.4%

©2022 Bloomberg L.P.