Aug 12, 2019

Student debt contributing to record number of Ontario insolvencies: Study

BNN Bloomberg

Student loan debt playing increasing role in Ontario insolvencies

Student debt is playing an increasingly large role in Canadian insolvencies, according to a new study.

In a study entitled ‘Student Debt Crisis – a Generation Buried in Student Debt’ released on Monday, Hoyes, Michalos & Associates Inc. found that student debt contributed to 17.6 per cent of Ontario’s reported insolvencies in 2018, a record over the firm’s nine years of collecting such data.

The study notes that the insolvencies related to student debt may not seem like a large amount, “but put in perspective with the number of student loan borrowers in relation to the overall population, the young age of these borrowers, and the relative health of the economy in recent years, and it is an epidemic.”

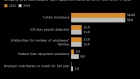

Among factors contributing to insolvencies according to the study are rising tuition costs and an increased debt load from borrowing from private lenders, but it also found that challenges getting a career started is also a key contributor.

“Graduates leaving university often end up working in unpaid internships, part-time positions, and minimum wage jobs. They are increasingly unable to find a stable job with enough income to support both student loan repayment and living expenses,” the study found.

“People filing insolvency with student loans are working, in fact, 86 per cent reported being employed. It is the quality of their job and income that is at issue.”

Student debt is also factoring into an increasingly high number of insolvencies for those aged 18 to 29, and is leading to a younger average age among insolvent student debtors. Student loan debt contributed to 35 per cent of the age bracket’s insolvency claims last year, with the average age of those filing dipping to 34.6 years old, compared to an average of 36.1 in 2012.

The study notes that student debt can’t be dissolved via bankruptcy or a consumer proposal until at least seven years after the debtor has left school, contributing to why the average age of insolvencies falls in the mid-30s.