Mar 27, 2024

Sweden’s Riksbank Opens Door to May Cut With Rate Kept at 4%

, Bloomberg News

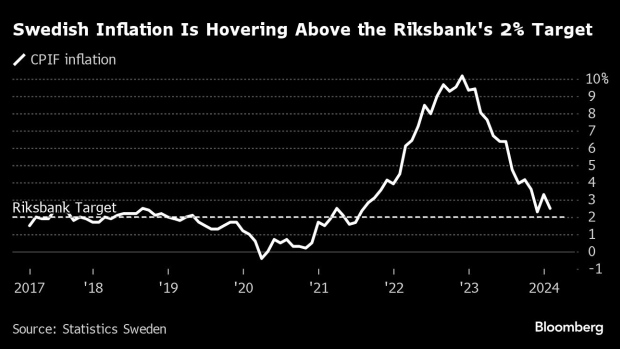

(Bloomberg) -- The Riksbank laid the groundwork for monetary easing as soon as May, offering Sweden’s recession-stricken economy the prospect of some imminent respite.

While policymakers led by Governor Erik Thedeen kept their benchmark interest rate at 4% as expected, they strengthened signals on a cut within the next quarter and projected a pathway to three possible reductions this year. The krona weakened after the decision.

“We want to get further confirmation that inflation is stabilizing close to the target before we go ahead with a rate cut,” Thedeen said at a news conference on Wednesday. “We indicate about a 50% probability of a 25 basis-point cut in May, but that is a forecast and there’s still significant uncertainty.”

The guidance suggests officials are sufficiently encouraged by recent consumer-price data to smell victory in a two-year battle against inflation that inflicted drastically higher borrowing costs on an economy now suffering the consequences.

Unless other peers suddenly pivot before then, a reduction announced on May 8 could make Sweden only the second among the world’s 10 most-traded currency jurisdictions, after Switzerland, to begin dialing down constriction.

“We’ve long been of the view that the Riksbank would start its easing cycle in June, given the drop in inflation that has manifested itself, but today’s meeting and statement suggests that May could also be a live meeting,” economist James Pomeroy at HSBC Holdings PLC said in a note. “The tone took a much more dovish turn, clearly taking note of the meetings across the rest of Europe in March, where June rate cuts were put firmly on the table.”

Investor bets currently show the Federal Reserve and the European Central Bank waiting until at least June. The Riksbank’s own decision that month will take place on June 27, well after those counterparts.

Traders in overnight swaps now price in a 79% chance of a Riksbank reduction at the May meeting, versus 67% seen Tuesday.

After saying in February that the rate could be lowered in the first half of 2024, the Swedish central bank didn’t provide much more clarity to investors and economists who were split on when exactly to pencil in that initial move to 3.75%.

Before a cut can happen, Riksbank officials will still need to resolve lingering doubts over consumer prices. Thedeen highlighted services inflation as a risk factor, and warned that if households get ahead of themselves amid expectations of impending rate cuts, a boost in demand could fuel further price increases.

A rapid rise in housing prices going forward could be an indicator that signals a problematic development for the Riksbank, the governor said.

“It is fundamentally a good thing if demand becomes somewhat firmer, but we don’t want a too rapid strengthening that leads to setbacks,” he said. “We will be extra vigilant about that since we had very rapid inflation in parts of the service sector only six months ago.”

What Bloomberg Economics Says...

“The Riksbank’s dovish message points to a possible rate cut in May or June, but a likely hit to the currency would probably deter it from moving at the earlier date — and before the European Central Bank. We maintain our call for a June cut, but recognize the risk of a May reduction is gaining ground.”

— Selva Bahar Baziki, economist. Click here to read more.

The Swedish krona, which has been the second-worst performer in the G-10 space of major currencies in the last month, fell as much as 0.3% versus the euro. It traded 0.2% weaker at 11.4996 at 1:05 p.m. in Stockholm.

A feeble currency is another source of risk that has resurfaced in recent weeks. If the weakening were to persist, retailers could hike prices on imported goods.

While Thedeen said a further drop in the value of the krona would impact future rate decisions, Swedbank AB analysts said the Riksbank emphasized international factors, rather than the domestic policy rate, as the main driver behind recent moves.

“This suggests that the Riksbank may look through the krona weakness, at least to some extent, and nevertheless go ahead with cutting the policy rate, even ahead of other central banks,” the analysts, including senior economist Jesper Hansson, said.

A cut in borrowing costs will relieve pressure on an economy that has shrunk for three consecutive quarters and is forecast by European Union officials to notch up the bloc’s weakest growth this year.

The Riksbank now sees a shorter recession in Sweden, with full-year expansion forecast at 0.3% for this year, up from an estimated 0.2% contraction.

While Sweden’s large export industry has offset some of the hit, unemployment is rising and rate-sensitive sectors are ailing, evidenced in subdued consumption and a plunge in housing investments.

--With assistance from Veronica Ek, Danielle Bochove, Stephen Treloar, Vassilis Karamanis, Alastair Reed, Joel Rinneby, Ott Ummelas, Anton Wilen, Christopher Jungstedt and Love Liman.

(Updates with comments from Thedeen and analysts from third paragraph.)

©2024 Bloomberg L.P.