Jan 2, 2020

U.S. dollar losses may just be getting started

, Bloomberg News

Dollar's `Downward Pressure' Will Please Trump in 2020: CIBC

The dollar had an awful December and things may only get worse.

That’s the view of a growing number of fund managers and strategists including those at M&G Investments Ltd., Brandywine Global Investment Management and ABN Amro Bank NV. A truce in the U.S.-China trade war, improving global growth and a shrinking yield premium on U.S. Treasuries will undermine the currency, they said.

“We expect to see better growth in the rest of the world ex-USA,” said Jack McIntyre, a portfolio manager at Brandywine Global Investment Management in Philadelphia. “The primary driver of dollar weakness will be a shift in relative economic growth rates between the U.S. and the rest of the world.”

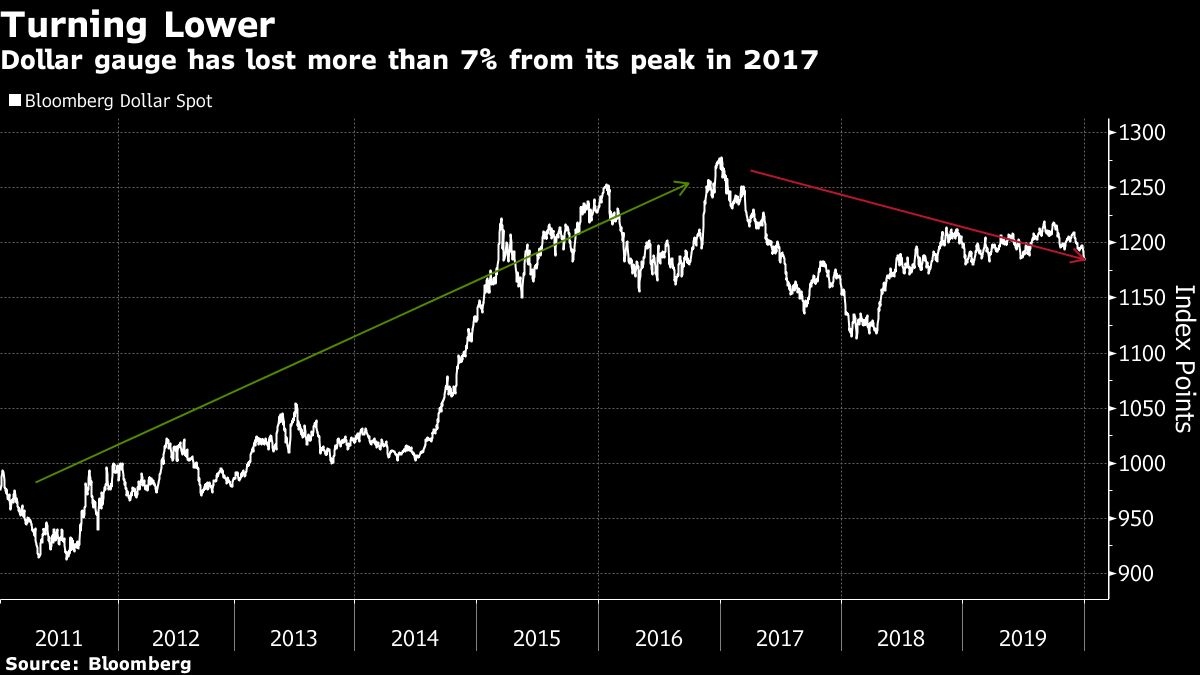

The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 global peers, slid 2% in December, the biggest monthly decline in almost two years. The gauge’s failure to sustain gains made earlier in 2019 may have drawn a line under a rally that saw it surge about 40% from a low in 2011 to a peak in early 2017.

The dollar started to weaken from October as Washington and Beijing close in on an initial deal to end their trade dispute. The agreement was confirmed by U.S. President Donald Trump in December.

“You had safe-haven support for the dollar in 2019, but we have a trade truce now,” said Georgette Boele, senior foreign-exchange strategist at ABN Amro Bank in Amsterdam. “The dollar is on a path of long-term weakness.”

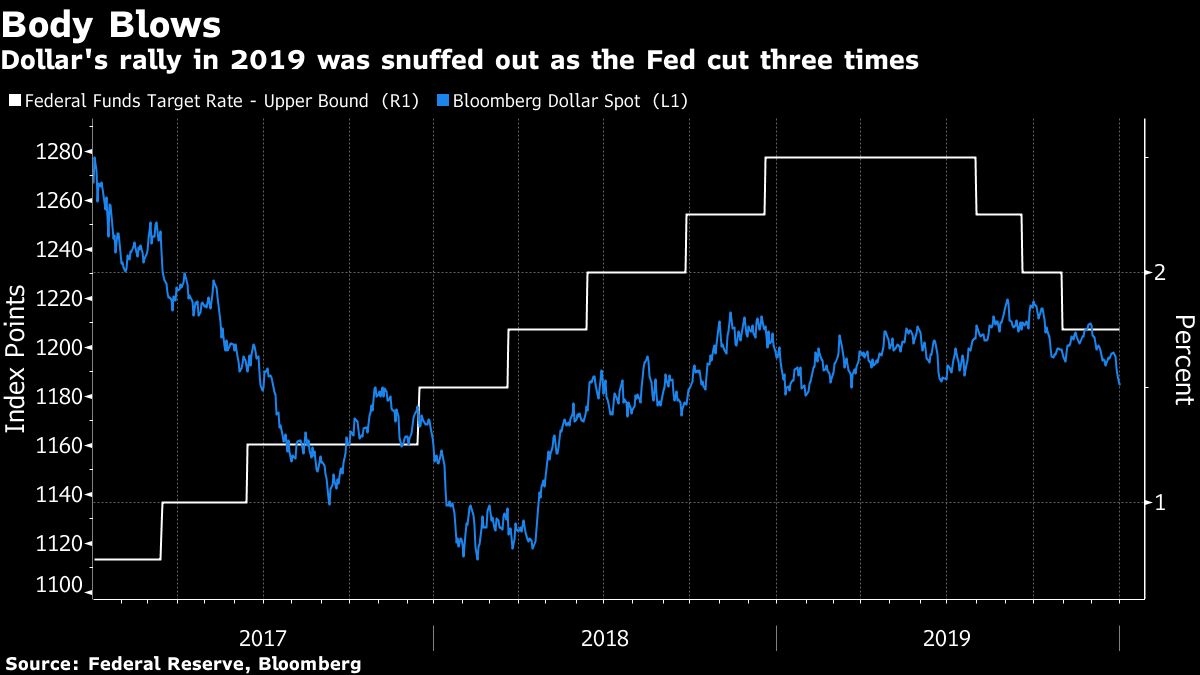

Fed Cuts

Another major pillar behind the dollar’s multi-year advance was also undermined as the Federal Reserve cut its benchmark rates in July, September and October to support slowing growth.

“The Fed does have some room to move lower in 2020, and for this reason I would expect a weaker dollar,” said Jim Leaviss, head of fixed-income at M&G Investments in London. There may also be “more pressure on the Fed if growth remains mediocre going into the U.S. elections,” he said.

Treasury 10-year yields dropped almost 80 basis points over the course of the year.

The Fed’s dovish pivot has seen the U.S. two-year yield advantage over similar-maturity German debt shrink to 217 basis points from around 350 basis points in late 2018, according to data compiled by Bloomberg.

Brandywine’s McIntyre sees Australia and Zealand’s currencies gaining against the greenback in 2020.

‘Not Convinced’

Not everyone is convinced the dollar is poised to keep weakening.

Citigroup recommends betting the greenback will strengthen against the euro and Canadian dollar on a view the U.S. economy will outperform the rest of the world. Goldman Sachs argues the dollar will only decline if the euro and yuan appreciate significantly, and it says that looks unlikely for now.

Back on the bearish side, National Australia Bank Ltd. is looking for further dollar losses, but sees more of a grind lower than a sudden sell-off.

“The dollar is set to begin 2020 fundamentally overvalued,” strategists at the bank including Ray Attrill in Sydney wrote in a research note. “We expect it to fall in 2020, but in a relatively sedate fashion barring resumption of Fed easing or dramatic improvement in growth prospects outside the U.S.”