Nov 29, 2023

Toyota Trimming Denso Stake May Raise About $1.9 Billion for EV Shift

, Bloomberg News

(Bloomberg) -- Toyota Motor Corp. and its affiliated suppliers will cut their shareholdings in electric parts maker Denso Corp., freeing up money that can be used to fund their shift to electric vehicles.

The world’s biggest carmaker plans to lower its stake in Denso to 20% from 24%, it said in a statement Wednesday. That could generate about ¥287 billion ($1.9 billion), based on Denso’s latest stock price. Denso said it will buy back as much as ¥200 billion worth of its own shares.

Japanese companies have been under pressure to reduce or eliminate their cross shareholdings. Toyota and its suppliers own a combined 33.6% of Denso, according to data compiled by Bloomberg. Toyota said in July it was selling some of its stake in telecommunications company KDDI Corp. for ¥250 billion.

“Toyota also intends to carefully review its capital ties with other group companies on an individual basis,” the company said in the statement. The proceeds will go toward electrification and diversification, Toyota said.

Toyota Industries Corp.’s stake will fall to around 5% from 8.8%, while parts maker Aisin Corp. is considering offloading its entire holding of 1.6%. Combined, the share sales would amount to ¥677.5 billion based on current prices, including over-allotment sales.

Toyota owns stock in Aisin and Toyota Industries as well. Denso and Toyota Industries also own shares in Toyota. Masahiro Yamamoto, chief officer of the accounting group, said Toyota is looking at reducing stakes it holds in other affiliates to around 20% for each.

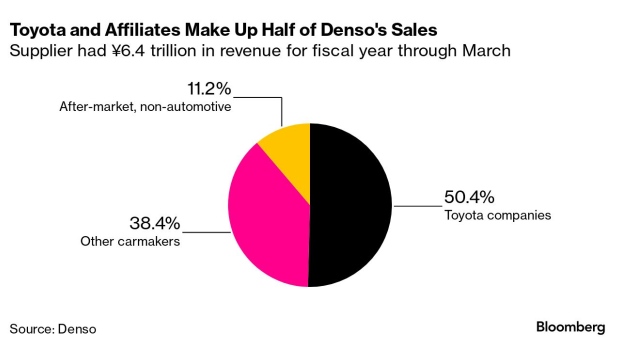

Denso has a long history with Toyota, after being split off from the carmaker in 1949 as a separate entity. The supplier makes everything from pumps and air conditioners, to spark plugs and navigation systems for Toyota and other carmakers. Sales to Toyota made up half of Denso’s ¥6.4 trillion in revenue for the fiscal year that ended in March.

“It’s a positive move,” said Seiji Sugiura, analyst at Tokai Tokyo Research. “Denso’s buyback amount was more than the market’s expectation.”

Cash from the stake sales will be used to fund Toyota’s shift to electric vehicles. Toyota is leading Japanese carmakers’ shift away from producing gas guzzlers toward a variety of technologies aimed at reducing emissions, including battery EVs, hybrids and hydrogen. The success of Tesla Inc. and rapid growth of the EV industry in China has fueled criticism that Japan was falling behind, to the frustration of Toyota Chairman Akio Toyoda.

Chief Executive Officer Koji Sato has pledged to roll out 10 new battery-powered EVs and sell 1.5 million annually by 2026. The company this month raised its operating profit forecast 50% after posting record quarterly earnings, helped by a weaker yen and robust demand.

Toyota said earlier this month it is investing another $8 billion in a plant in North Carolina that will make batteries for fully electric and plug-in hybrid models.

Analysts expect the stake sales could trigger other cuts in shareholdings by Toyota.

“The trend of selling policy shareholdings and dissolving cross-shareholdings is likely to spread not only to Toyota and Denso, but also to other companies within the Toyota group,” said Bloomberg Intelligence analyst Tatsuo Yoshida.

Shares in Denso rose less than 1% on Wednesday, after declining 4.9% a day earlier after Reuters first reported on the potential stake sale. Toyota shares rose 1.7%, leaving them up 55% this year.

(Updates with analyst’s comment, affiliate share sales.)

©2023 Bloomberg L.P.