Oct 10, 2023

U.S. stocks rise as Wall Street dials back Fed wagers

, Bloomberg News

BNN Bloomberg's mid-morning market update: Oct. 10, 2023

Stocks rose and Treasury yields fell after comments from Federal Reserve officials bolstered speculation the central bank is heading toward another pause in interest-rate hikes. Oil edged lower, following its biggest rally since April.

The S&P 500 advanced for a third straight day, with some analysts also citing a rebound from oversold levels. Amazon.com Inc. gained amid its fall sale for Prime subscribers. PepsiCo Inc. climbed on a bullish forecast. A measure of U.S.-listed Chinese shares added 3.1 per cent as Bloomberg News reported the Asian nation is considering new economic stimulus. European equities rallied the most since November 2022.

Treasuries gained, catching up with the global bond rally on Monday, when cash trading in the U.S. was closed. Ten-year yields sank 15 basis points to 4.65 per cent. Fed swaps show about a 60 per cent chance the Fed will stay on hold in December, compared with 60 per cent odds of another hike by then, just a week ago. The dollar fell for a fifth straight day, its longest losing streak since July.

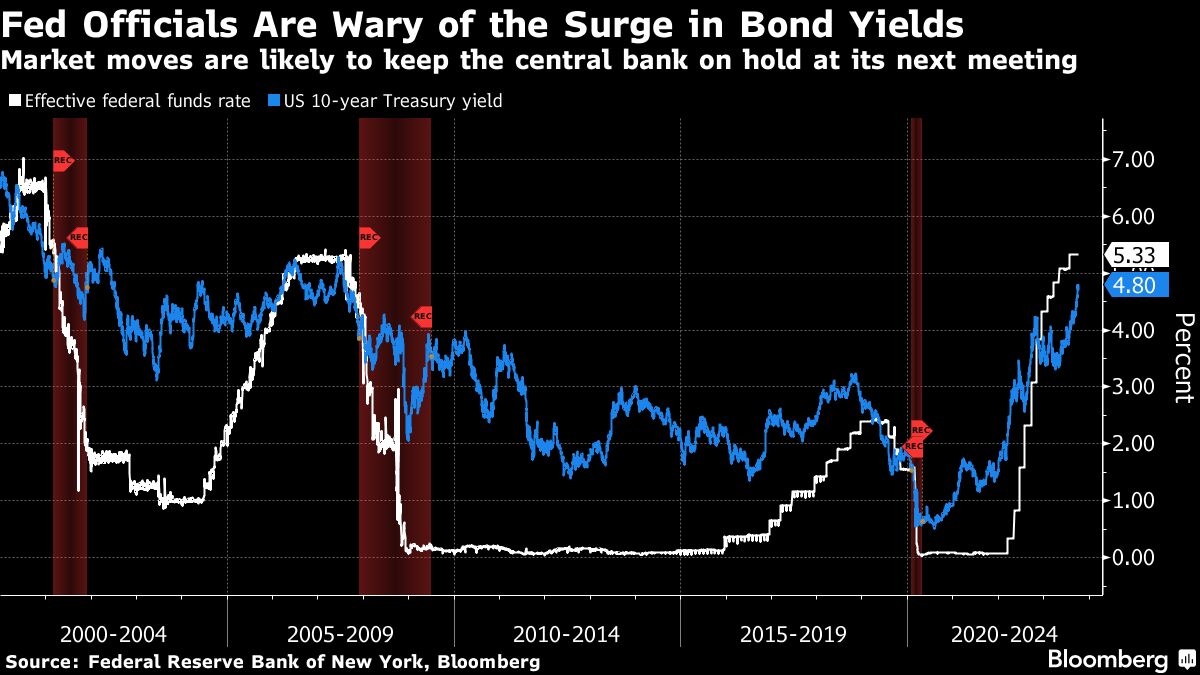

In a week jam-packed with speeches from U.S. central bank officials, Fed Bank of Atlanta President Raphael Bostic said policy is restrictive enough to lower prices to the 2 per cent goal. His Minneapolis counterpart Neel Kashkari said it’s “possible” that rising yields may mean Fed has to do less.

“Policymakers have begun to acknowledge a lesser need for further policy action given financial conditions have tightened considerably after the recent surge in Treasury yields,” said Ben Jeffery at BMO Capital Markets. “This acknowledgment may have reduced angst around the need for additional rate increases.”

Investors will be watching for any hints in the September Fed meeting minutes due Wednesday that would suggest the Fed may not follow through with the last hike indicated in its economic projections, according to Anna Wong at Bloomberg Economics. Two critical upcoming economic indicators — Thursday’s consumer price index and Friday’s University of Michigan consumer-sentiment survey — may give a more definitive read, she noted.

“Risks to CPI this week are to the upside, reflecting dynamics in individual components such as auto prices. An upside surprise may see even more market buy-in to the downside, as investors are acutely concerned about rising energy prices,” said Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

While Goodwin said an additional hike may still be in the cards, she cited the fact that market financial conditions are tightening — reflecting higher risk in the real economy, government funding, and geopolitical developments.

“This may be enough to key the Fed on pause,” Goodwin noted.

Global investors also kept a close eye on geopolitics. President Joe Biden said the U.S. is “surging” military assistance to Israel in the wake of the Palestinian militant group Hamas’ surprise attack.

The shekel regained its footing as the central bank dueled short sellers to contain the market fallout from Israel’s conflict with militant group Hamas. The currency strengthened as much as 1 per cent in the first half hour of trading on Tuesday and was little changed against the dollar.

Billionaire investor Paul Tudor Jones told CNBC the current geopolitical environment is the “most threatening and challenging” he’s ever seen in the wake of Hamas’s attack on Israel over the weekend and predicted the U.S. will enter into a recession early next year.

European gas prices jumped, with Finland is on high alert as it suspects a gas pipeline leak in the Baltic Sea was caused by a deliberate act of destruction, fueling concerns about the safety of Europe’s energy infrastructure. Base metals sank amid fresh fears over property turmoil in China.

Corporate News

- Boeing Co. said it delivered 27 commercial jets in September, marking the third consecutive month that shipments have declined as manufacturing glitches put its annual target in jeopardy.

- General Motors Co. reached a contract with its Canadian union, ending a strike that began about 13 hours earlier at three plants in Ontario.

- Birkenstock Holding Plc’s initial public offering is expected to price Tuesday after the trading day ends, the last of four big listings seen as pacesetters for U.S. equity markets.

- LVMH’s sales growth softened in the third quarter as shoppers reined in spending on high-end Cognac and costly handbags, more evidence the post-pandemic luxury boom is waning.

- Drugmaker Mallinckrodt Plc won court approval for a new debt-reduction plan that will slash about US$1 billion from the sum the company must pay victims of America’s opioid epidemic.

Key events this week:

- Germany CPI, Wednesday

- NATO defense ministers meeting in Brussels, Wednesday

- Russia Energy Week in Moscow, with officials from OPEC members and others, Wednesday

- U.S. PPI, Wednesday

- Minutes of Fed’s September policy meeting, Wednesday

- Fed’s Michelle Bowman and Raphael Bostic speak at separate events, Wednesday

- Japan machinery orders, PPI, Thursday

- Bank of Japan’s Asahi Noguchi speaks, Thursday

- UK industrial production, Thursday

- U.S. initial jobless claims, CPI, Thursday

- European Central Bank publishes account of September policy meeting, Thursday

- Fed’s Raphael Bostic speaks, Thursday

- China CPI, PPI, trade, Friday

- Eurozone industrial production, Friday

- U.S. University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan, Wells Fargo, BlackRock results as the quarterly earnings season kicks off, Friday

- G20 finance ministers and central bankers meet as part of IMF gathering, Friday

- ECB President Christine Lagarde, IMF Managing Director Kristalina Georgieva speak on IMF panel, Friday

- Fed’s Patrick Harker speaks, Friday

Stocks

- The S&P 500 rose 0.5 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.6 per cent

- The Dow Jones Industrial Average rose 0.4 per cent

- The MSCI World index rose 1.1 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.3 per cent

- The euro rose 0.4 per cent to $1.0604

- The British pound rose 0.4 per cent to $1.2286

- The Japanese yen fell 0.1 per cent to 148.67 per dollar

Cryptocurrencies

- Bitcoin fell 0.6 per cent to $27,409.41

- Ether fell 0.7 per cent to $1,566.11

Bonds

- The yield on 10-year Treasuries declined 15 basis points to 4.65 per cent

- Germany’s 10-year yield was little changed at 2.77 per cent

- Britain’s 10-year yield declined five basis points to 4.43 per cent

Commodities

- West Texas Intermediate crude fell 0.7 per cent to $85.77 a barrel

- Gold futures rose 0.5 per cent to $1,873.80 an ounce