Oct 4, 2023

UK Trails Europe in Developing Green Economy, New Study Shows

, Bloomberg News

(Bloomberg) -- The UK was falling behind Europe in developing green industries, even before backsliding by Rishi Sunak’s government on net zero policies alarmed investors.

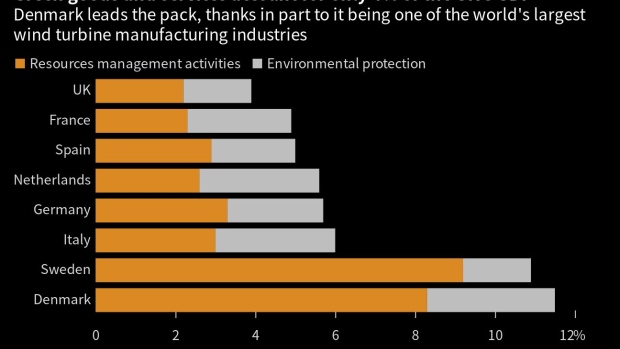

Contrary to the government’s position that the UK is ahead and can therefore afford to slow down, green goods and services contributed just 3.9% of the British economy compared with 5.8% for the European Union in 2019, according to a report by the Institute for Public Policy Research. In Denmark and Sweden, the figures were 11.5% and 10.9%, respectively, while Germany was 5.7%.

The findings come after Sunak softened parts of the UK’s green agenda in September, including a ban on petrol car sales. Criticism of that retreat chimes with the new report, which finds the government has missed opportunities to create hundreds of thousands of jobs by failing to invest in the net-zero transition.

“Our analysis highlights the glaring disparity between the UK and its international competitors in harnessing the economic boons of the green sector,” said Josh Emden, senior research fellow at IPPR. “The roadmap to net zero is not just a climate necessity but an economic opportunity waiting to be tapped.”

If the UK had emulated Denmark in developing an industry to manufacture wind turbines, it could have created 98,000 more jobs. Last month, the offshore industry took a hit when a UK government auction for offshore wind failed to attract any bids, even after developers repeatedly warned the government that better incentives were needed to attract investment.

“The biggest influence on investors is a regulatory framework that offers the most incentives,” said Brennan Spellacy, chief executive officer of carbon-credit platform Patch.

Read More: UK Creates Policy Vacuum With No Net Zero Plan, Energy Boss Says

There’s also a stark contrast between the UK and the US, where the investment environment has been energized by the Inflation Reduction Act, according to Spellacy.

Of the £1.4 trillion ($1.7 trillion) of investment that’s needed to get the UK to its net zero target, 70% has to come from the private sector, according to industry association Energy UK. “There is a lot we can do to get more capital into projects with tax incentives,” said Emma Pinchbeck, CEO of Energy UK.

The prime minister has cast the decision to delay the UK’s ban on the sale of petrol and diesel cars, defer the phase out of gas boilers and scrap energy efficiency standards for landlords as an effort to protect families struggling with bills. However, he has been accused of trying to weaponize net zero ahead of elections next year.

“While other nations are forging ahead in the global green race, the UK is moving into reverse gear,” said Luke Murphy, an associate director at IPPR.

Read More: UK Lawmakers Call for Government to Justify Green Policy Retreat

(Updates with contribution for Germany in second paragraph. An earlier version of this story corrected the figures for Denmark and Sweden.)

©2023 Bloomberg L.P.