Nov 28, 2023

Unlocking Egypt's oil potential: TAG Oil positions for breakthrough fracking venture

Presented by: Market One

- Egypt is a significant but underappreciated player in the global oil and gas market, producing approximately 700,000 barrels of oil per day

- TAG Oil Ltd. is undertaking Egypt's largest fracking operation in the Badr Oil Field's BED-1 which has the potential for renewed oil development through unconventional methods

- The company's strategic approach, experienced management, and ongoing drilling activities suggest potential for significant oil production, with upcoming flow tests expected to be a key catalyst

With production of approximately 700,000 barrels of oil per day (“bopd”), Egypt is an underappreciated player in the global oil and gas market.

The country possesses a wealth of oil and gas reserves, which are part of a diversified economy that includes mining, agriculture, shipping, tourism and textiles.

A new area opening up in Egyptian oil and gas are unconventional plays, fracking ventures that promise to tap — until now — inaccessible oil and gas reservoirs.

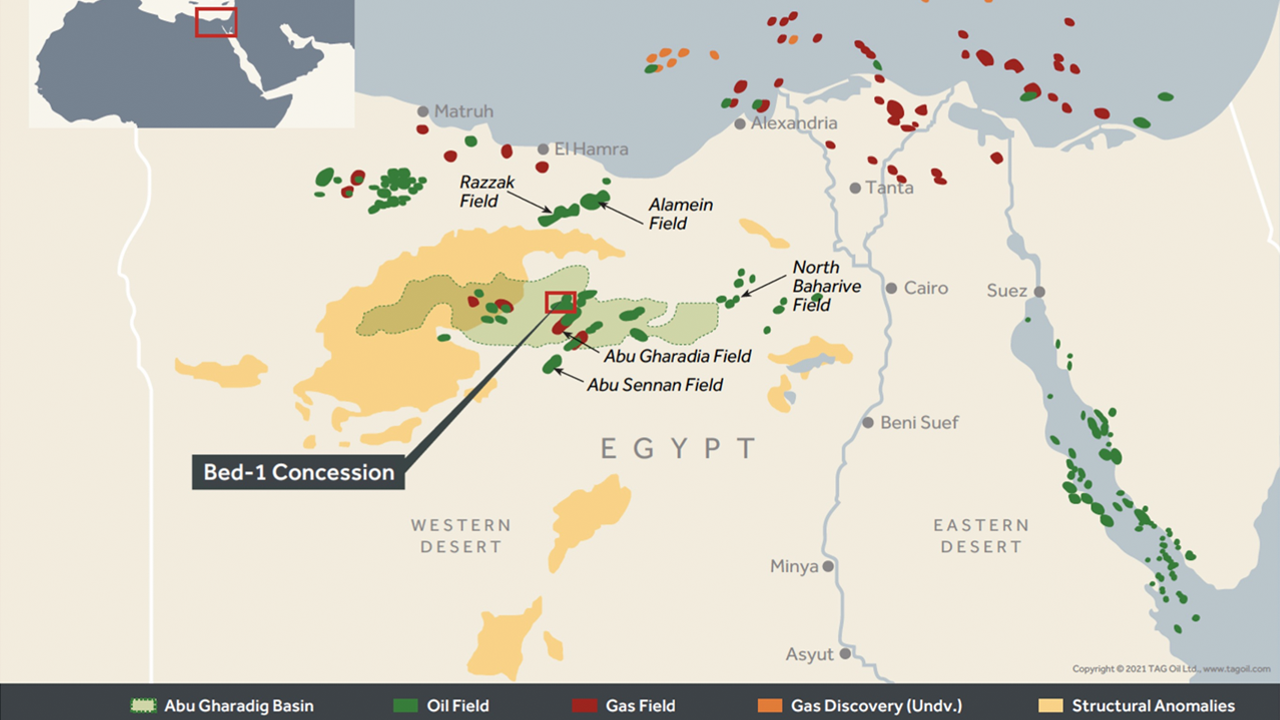

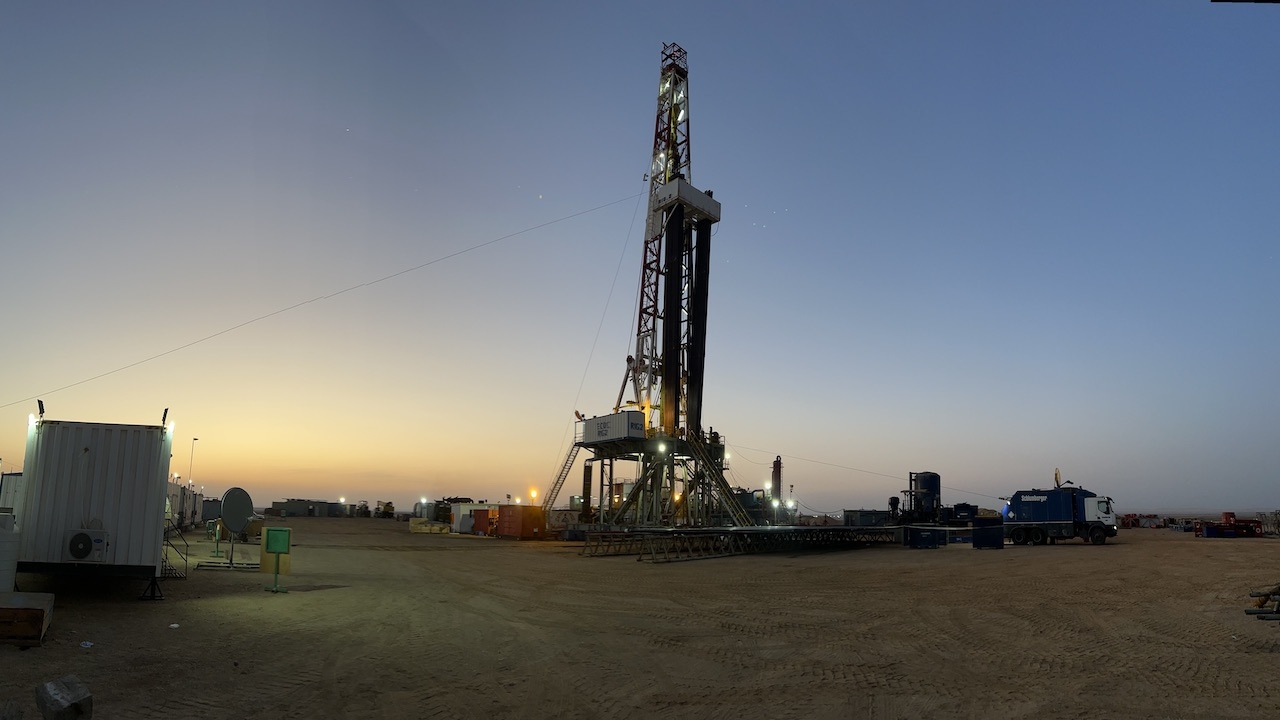

One Vancouver-based firm, TAG Oil Ltd. (TSXV: TAO | OTCQX: TAOIF), is in the process of executing Egypt’s largest frack on the Badr Oil Field’s BED-1 Field. The field is in the country’s Western Desert and has been the site of past light oil production by Shell.

While much of the “easy” oil has been produced at Badr, the Abu Roush F (“ARF”) formation on which it sits is wide open to oil development via unconventional methods.

“First big catalyst for TAG Oil will be when we flow test this well in just over a month.”

— Toby Pierce, Chief Executive Officer & Director, TAG Oil Ltd.

Tapping into Egypt’s rich history and geological advantage

TAG Oil is currently drilling the first horizontal well on the Badr Oil Field, whose ARF formation in the BED-1 field is home to over 500 million barrels of oil-initially-in-place according to a recent independent resource evaluation.

Shell discovered the Badr Field in 1982 and produced an estimated 90 million barrels of light oil over 30 years from an area that lies above the ARF. Since Shell surrendered BED-1 in 2021, it has been operated by BPCO, a wholly owned subsidiary of the Egyptian General Petroleum Corporation that is a state-owned oil and gas company.

Current production from zones that are deeper but still above the unconventional ARF target at BED-1 is 5,000 bopd and the field has a 25,000-barrel processing facility.

TAG Oil entered into a petroleum services agreement in the Badr Oil Field in October 2022, and is currently in a Phase 1 evaluation period.

Building on the work of prior oil giants like Shell has been key to TAG Oil’s strategy. The company’s CEO, Toby Pierce, notes, “most of the major oilfields in Egypt were discovered by major oil companies.”

The result is an oil field in Egypt’s Western Desert that is open to renewal with fracking. In terms of geological similarities, the ARF has an analog in the renowned Eagle Ford Shale play in South Texas.

Pierce is excited about those similarities, because “the Eagle Ford formation produces over 1.2 million barrels of oil per day.”

That is almost double what is produced in all of Egypt. If, as was the case with Eagle Ford, fracking can produce significant oil at Badr, there is potential for the technique to unlock a large amount of production in the region.

Fueling a promising path forward

Hydra Capital analyst, Malcolm Shaw, thinks TAG Oil’s emphasis on Egypt is well placed. “It’s a wonderful place to look for oil and gas — TAG Oil’s field is covered by infrastructure and there’s a skilled work force in the region, plus Egypt has a long-held respect for contracts.”

In addition to Pierce, TAG Oil has Abby Badwi as its Executive Chairman and Director, a proven oil and gas executive who has shepherded several public oil and gas companies to sales.

Those include the sale of Kuwait Energy in 2019 for US$830 million, the sale of Albanian oil company Bankers Petroleum in 2016 for $790 million, the sale of Verano Energy in 2014 for $200 million, and the sale of Rally Energy in 2007 for $890 million.

This collection of wins has given Badwi a strong network of contacts in the oil and gas industry, and particularly in the Middle East North Africa region. Shaw comments, “Management has done this before, and Abby knows Egypt as well as you can know Egypt.”

Combined with the team’s experience in unconventional plays, this management experience should pay big dividends for TAG Oil as it looks to unlock the potential of the ARF formation.

Already, TAG Oil’s recent vertical BED 1-7 well has provided proof of concept at the BED-1 field with a cumulative production of approximately 10,000 barrels of oil from the ARF since April 2023.

In September 2023, the company announced and completed the vertical portion of its BED4-T100 horizontal well and will look to complete up to 1,000m of horizontal drilling there in December.

According to Pierce, the “first big catalyst for TAG Oil will be when we flow test this well in just over a month.” Depending on the success of this well, another 2–3 wells are planned for 2024.

Shaw adds: “This is not a traditional wildcatting play. TAG Oil doesn’t need to find the oil, the oil is there, it’s just a matter of extraction.” In that sense, he says, “it’s more educated betting than pure wildcatting.”

After all, this is field that has been exploited for more than 40 years. There are a lot of past wells to provide data, but fracking technology and the company’s depth of experience is allowing TAG Oil to explore a horizon that was not accessible before.

TAG Oil is a company that is very much at an inflection point. If the company can deliver significant oil flow from the current T-100 well, it would serve as a promising catalyst for the implementation of their 20-well field development plan.

And that could potentially have a marked effect in TAG Oil’s share price.

Learn more about TAG Oil Ltd. on their website and by following them on social media: