Feb 1, 2022

UPS surges after 2022 forecasts exceed Wall Street's estimates

, Bloomberg News

United Parcel Service Inc. jumped after higher prices and robust deliveries spurred the courier to issue forecasts that topped analysts’ expectations.

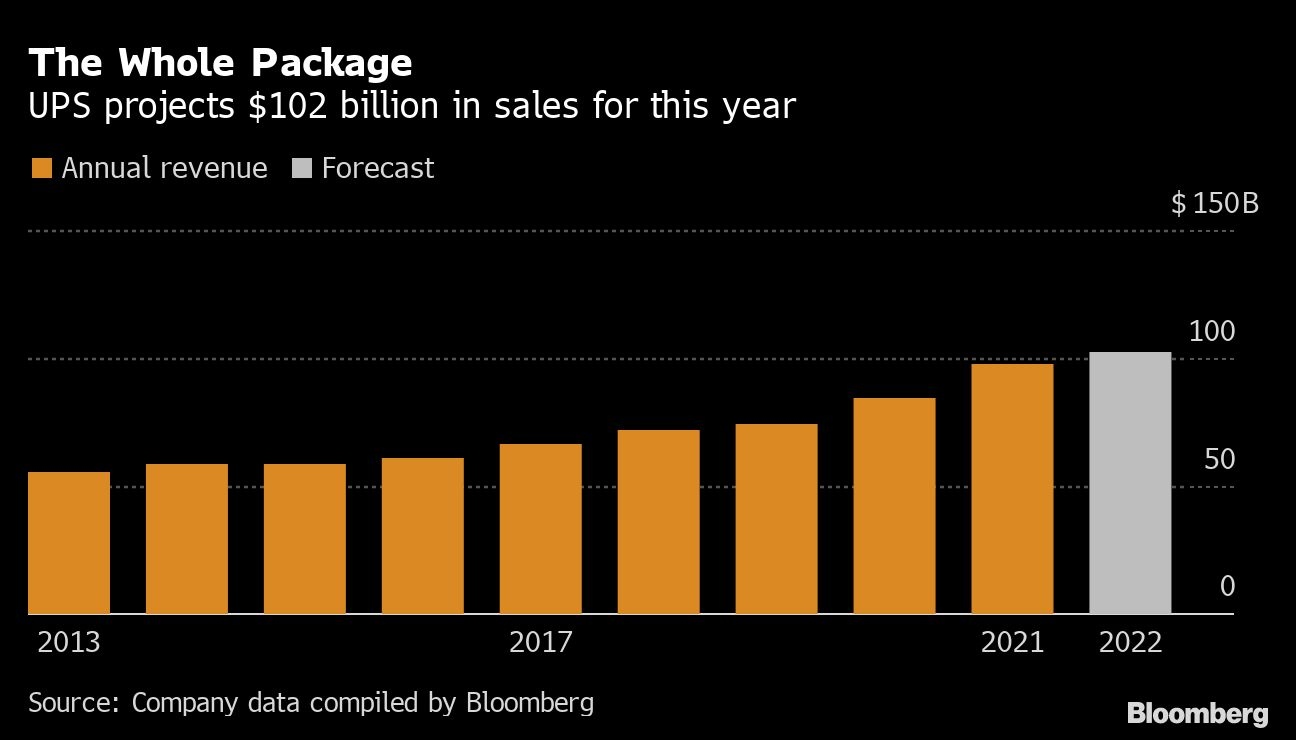

UPS projected revenue of about US$102 billion this year and an adjusted operating margin of 13.7 per cent. The company previously hadn’t expected to reach those targets until 2023. Analysts had estimated 2022 revenue would be US$100 billion.

Since Carol Tome took over as chief executive officer in June 2020, the company has given priority to boosting profit margin over increasing volume. That’s meant raising prices and focusing on small customers, who typically don’t get the discounts negotiated by big users.

“The execution of our strategy is delivering positive financial results and driving strong momentum as we move into 2022,” Tome said in a statement Tuesday.

Fourth-quarter adjusted earnings jumped to US$3.52 a share. Analysts had projected US$3.10 for the latest period, based on the average of estimates compiled by Bloomberg. Sales increased 12 per cent to US$27.8 billion, while Wall Street expected US$27.1 billion.

UPS climbed 7.3 per cent before the start of regular trading in New York. The stock had dropped 5.7 per cent this year through Monday while the S&P 500 declined 5.3 per cent.

The company faced increased expenses to hire seasonal workers and for keeping workers safe from COVID-19. The courier was able to weather the U.S. labor shortage because its unionized drivers and warehouse workers earn the most in the parcel industry. That helped the Atlanta-based company achieve an on-time delivery performance of 97 per cent during the peak holiday season while FedEx Corp. logged 88 per cent, according to ShipMatrix.

Sales at the U.S. domestic unit rose 12 per cent in the quarter, helped by an 11 per cent increase in revenue per piece. International sales jumped 13 per cent as revenue per piece rose 16 per cent while volume fell.

The company’s adjusted operating profit margin, which had been declining before the pandemic as a boom in e-commerce spurred deliveries to homes, surged to 14.2 per cent in the fourth quarter from 11.5 per cent a year earlier.

UPS stands to benefit this year from more business activity and the return of office workers if precautions from the COVID-19 pandemic subside. Business parcels are more profitable than residential service because drivers travel less between customers and tend to drop off more packages at each stop.

The company raised its quarterly dividend by 49 per cent to US$1.52 a share and plans to repurchase at least US$1 billion of shares this year. UPS projected US$5.5 billion in capital spending for this year, while analysts have been expecting US$4.96 billion.