Apr 14, 2023

US Economy Is Cooling Steadily as Consumers, Factories Pull Back

, Bloomberg News

(Bloomberg) -- The US economy moderated gradually as the first quarter drew to a close, with elevated inflation and borrowing costs restricting household spending and manufacturing activity.

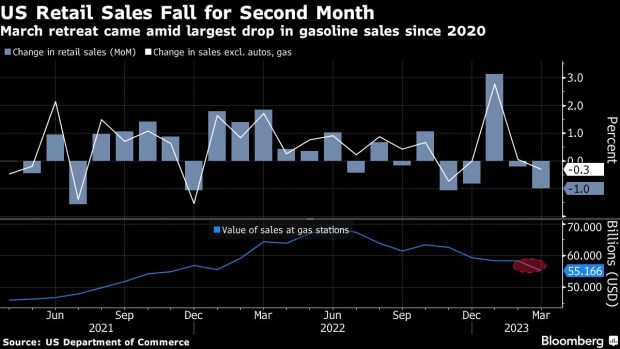

March retail sales slid by the most in four months, largely explained by a slump in receipts at gas stations and a slowdown at auto dealers. A drop in factory output exceeded expectations, though upward revisions to the prior two months allowed production to squeeze out a modest advance in the first quarter.

Taken together with signs of moderating inflation, the latest batch of data is consistent with a steady cooling of economic activity late in the quarter rather than a more significant slump in light of stress in the banking sector. Traders still expect the Federal Reserve will opt for another quarter-point hike in rates at its next meeting, but some policymakers have recently hinted that they’d be open to a pause.

Moreover, price pressures are only slowly dissipating, and the University of Michigan’s survey of consumers showed year-ahead inflation expectations jumped in early April by the most in nearly two years amid higher gas prices. Household views of inflation over the near term tend to swing from month to month.

Consumers expect prices will climb at an annual rate of 4.6% over the next year, up from 3.6% in March, according to the preliminary April reading. Nonetheless, they see costs rising 2.9% over the next five to 10 years, holding at that level for a fifth month.

Fed officials “will look more at the fact that it’s bouncing all over the place as a point that inflation expectations remain somewhat uncertain and that they can’t take the glimmers of good news for granted,” said Justin Weidner, an economist at Deutsche Bank AG.

Also, the Fed focuses more on longer-term views and “typically looks through oil-price spikes,” since they don’t get passed through to core prices, Bloomberg economist Eliza Winger said in a note.

A report earlier this week showed underlying consumer prices, which strip out food and energy, displayed hints of moderating in March, but are still rising at a brisk pace. While producer prices fell even more, higher oil prices stemming from OPEC+ supply cuts are poised to limit wholesale disinflation.

Retail Sales

The Commerce Department’s retail sales report showed the value of purchases dropped 1%. Stripping out gasoline and autos, sales fell a more moderate 0.3%, a smaller decline than forecast. The figures aren’t adjusted for inflation.

So-called control group sales — which are used to calculate gross domestic product and exclude food services, auto dealers, building materials stores and gasoline stations — also fell by less than expected.

The data add to evidence that momentum is slowing in household spending and the broader economy as financial conditions tighten and inflation persists. While odds still favor a rate hike at their May 2-3 meeting, Fed officials have indicated that they are getting closer to pausing.

“A common theme in this morning’s data is that things were relatively robust and good in the first quarter, but they’re clearly slowing down into the second quarter,” said Yelena Shulyatyeva, senior US economist at BNP Paribas. “So you can see that in control group retail sales, you can see that in industrial production numbers, particularly in the manufacturing sector.”

The Fed’s industrial production report showed output at factories fell for the first time this year as companies show signs of ratcheting back investment plans amid higher borrowing costs. When paired with softer consumer spending, that raises the odds of recession.

Still a bright spot in the larger picture is the labor market, as unemployment is historically low and employers are still adding jobs at a strong pace. However, as demand for workers comes down and layoffs pick up, that could restrict further wage gains.

--With assistance from Reade Pickert.

©2023 Bloomberg L.P.