Apr 3, 2023

US Gasoline Prices Seen Rebounding to $4 a Gallon on OPEC+ Cut

, Bloomberg News

(Bloomberg) -- The surprise OPEC+ production cut will undoubtedly bring higher gasoline bills to US drivers as energy markets climb on tighter supplies.

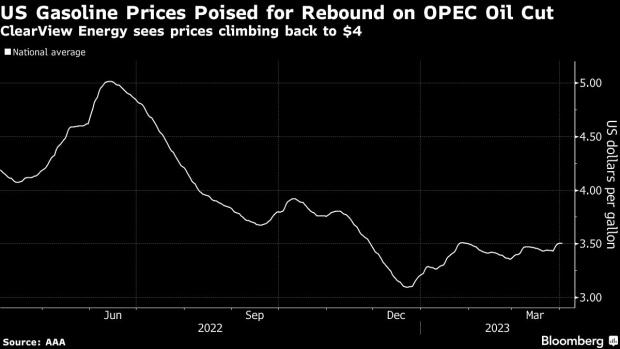

For pump prices, the move could add more than 50 cents a gallon to the US average, said Kevin Book, managing director of ClearView Energy Partners. The national average is now at about $3.50.

A rally now would come just ahead of the busy summer driving season, when demand typically peaks. What’s more: There’s “room to run on the upside, because second-half oil balances were already poised to tighten considerably,” Book said.

Gasoline prices have cooled after surging above $5 last year. But the production cuts from OPEC+ mean that more analysts now forecast that oil could reach $100 a barrel, which would likely bring more energy-driven inflation and a rebound for pump prices.

Still, while Organization of Petroleum Exporting Countries and its allies control supply, the US and global economies remain a wildcard for demand and it’s unclear how long the jump for oil prices will last. When it comes to gasoline, “there will be an impact — oil is up big today, but it’s a knee-jerk reaction,” said Patrick De Haan, head of petroleum analysis at GasBuddy. “I’m not convinced that the cut will have much lasting power.”

©2023 Bloomberg L.P.