Jan 30, 2024

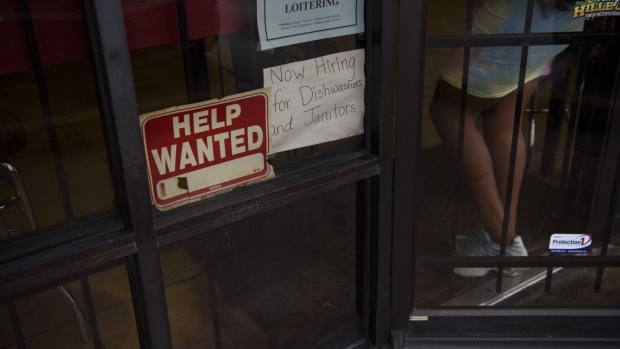

US Job Openings Rebound Above 9 Million, Highest in Three Months

, Bloomberg News

(Bloomberg) -- US job openings unexpectedly rose in December to the highest level in three months while fewer Americans quit their jobs, indicating workers are growing more cautious even as labor demand remains strong.

Vacancies increased to 9 million from an upwardly revised 8.9 million reading in the prior month, the Bureau of Labor Statistics Job Openings and Labor Turnover Survey, known as JOLTS, showed Tuesday. The December figure exceeded all estimates in a Bloomberg survey of economists.

At the same time, the number of people who voluntarily quit their job fell to 3.4 million, the lowest in nearly three years. The metric has been largely declining in recent months, which may imply Americans are feeling less confident in their ability to find other jobs in the current market or to get new jobs that are better paid.

The report underscores what’s been a gradually moderating labor market, and the trend has been choppy along the way. While the pickup in openings highlights solid demand for workers that has kept the economy out of recession, the declining number of quits shows employees are increasingly clinging to their jobs.

“The report paints a picture of a labor market that was historically favorable to workers in 2023, but in which workers felt the ground moving under their feet,” ZipRecruiter Chief Economist Julia Pollak said in a note. “If JOLTS indicators hold steady at current levels, 2024 will be a stable, low-churn year. But if they continue to deteriorate as they did over the course of 2023, there is a clear risk of over-cooling.”

What Bloomberg Economics Says...

“Workers aren’t convinced they can find new jobs at higher wages, keeping the quits rate below pre-pandemic levels. All told, wage and inflation pressures emanating from the labor market will likely continue dissipating.”

— Stuart Paul. To read the full note, click here

Hiring and layoffs ticked up. Federal Reserve officials are looking for softer labor demand ideally through fewer postings and slower hiring rather than outright job losses.

Policymakers are expected to hold interest rates steady at the highest level in two decades at the end of their policy meeting Wednesday. While officials have already started discussing lowering borrowing costs, they have said they want to see a sustained pullback in inflation pressures before they start cutting interest rates.

Treasury yields popped while the S&P 500 remained lower after the release. Another report out Tuesday showed US consumer confidence increased in January to the highest level since the end of 2021, due in part to more upbeat views on the labor market.

The advance in openings was mainly concentrated in professional and business services, which registered the biggest increase in four months. Education and health services as well as manufacturing also saw a pickup in postings.

While the overall level of layoffs remain subdued, they’ve been rising in transportation and warehousing, which is now at the highest level since June 2020. United Parcel Service Inc. said Tuesday it plans to cut 12,000 management jobs, in part to offset higher union labor costs.

The ratio of openings to unemployed people held at 1.4, according to the JOLTS report. The figure has eased substantially over the past year, indicating labor supply and demand has moved into better balance. At its peak in 2022, the ratio was 2 to 1.

Tuesday’s data kicks off a slew of releases that will offer insights into the state of the job market heading into the new year. A report due Wednesday is forecast to point to easing employment costs at the end of 2023, while the government’s jobs report due Friday is projected to show US employers added around 185,000 positions in January.

Some economists have questioned the reliability of the JOLTS statistics, in part because of the survey’s low response rate.

Big Take DC: Economists Could Be Using Bad Data to Make Big Decisions (Podcast)

--With assistance from Chris Middleton and Jarrell Dillard.

(Adds economist’s comment)

©2024 Bloomberg L.P.