Jul 13, 2021

VW Targets Higher Returns as Batteries and Software Boost Sales

, Bloomberg News

(Bloomberg) -- Volkswagen AG ratcheted up its mid-decade profitability goal as it hones plans to become the electric-car leader and cash in on what it expects to be a massive new revenue stream from software.

Europe’s largest automaker will target an 8% to 9% operating return on sales in 2025, up from 7% to 8% previously. After wooing investors with a Tesla Inc.-style briefing in March, Chief Executive Officer Herbert Diess is elaborating further on VW’s plans to phase out combustion engines and equip cars with software systems that can update automated driving capabilities and other features over the air.

“We set ourselves a strategic target to become global market leader in electric vehicles -- and we are well on track,” Diess said in a statement. “The next much more radical change is the transition toward much safer, smarter and finally autonomous cars.”

Key stakeholders backed Diess’ action plan last week when the supervisory board extended the former BMW AG executive’s contract through 2025. He’s been retooling the sprawling industrial behemoth to meet stricter emissions rules and keep Tesla and other new competitors at bay, plotting half a dozen battery factories in Europe alone and switching assembly lines globally to build the broadest range of EVs.

Highlights of the 2030 strategy Diess will brief investors on Tuesday include:

- Seizing a share of 1.2 trillion-euro ($1.42 trillion) software-enabled sales that VW expects to expand the overall global mobility market to 5 trillion euros by 2030, from 2 trillion euros today.

- Increasing the share of total investment that goes to electrification and digital offerings; VW already has budgeted 73 billion euros for those areas from this year through 2025, half of overall spending.

- Spending 800 million euros on a new research facility in Wolfsburg -- where the German company is based -- that will design a new EV platform open to other carmakers.

- Building small EVs in Spain, with final decisions dependent on securing subsidies and other factors.

VW’s namesake brand already has said it plans to stop selling combustion cars in Europe between 2033 and 2035, followed by the U.S. and China at a later stage. Audi sees continued demand for combustion engines in China beyond 2033, but intends to fade them out in other markets by then.

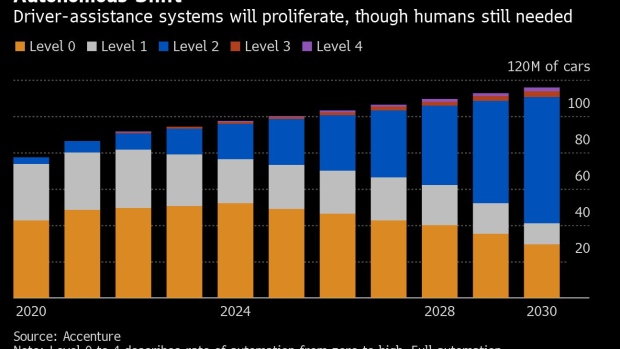

Even as EVs take center stage, Diess has repeatedly said that software and self-driving functions will to bring about an even deeper transformation of the industry with cars becoming sophisticated connected devices.

VW plans to offer autonomous driving in major markets worldwide, aided in part by cooperation with Ford Motor Co. and affiliate Argo AI LLC. In China, VW’s largest market, the carmaker has sought partnerships with local tech companies to be among the first to offer autonomous driving, mostly in private cars.

The manufacturer remains on solid footing to finance the shift. First-half operating profit rose to 11 billion euros, ahead of pre-pandemic levels, VW said Friday in a preliminary earnings release, with 10 billion euros in net cash flow. However, fallout from the global semiconductor shortage may be more pronounced during the second half of the year. Analysts also have warned about a slowdown in VW’s business in China and tepid early demand for the VW brand’s electric ID. cars there.

“For now, VW’s ID. product still has too many serious teething issues,” Sanford Bernstein analyst Arndt Ellinghorst said Friday in a report. The company’s internal combustion-engine business “needs to be managed down in a socially acceptable way whilst battery manufacturing and software capabilities are internalized.”

©2021 Bloomberg L.P.