Nov 10, 2022

Weakening Yen Trend May Be History as CPI Print Slams Dollar

, Bloomberg News

(Bloomberg) -- The end of a torrid period for the yen looked tantalizing close Friday as the US inflation report pushed the currency to the brink of breaking its weakening trend against the greenback.

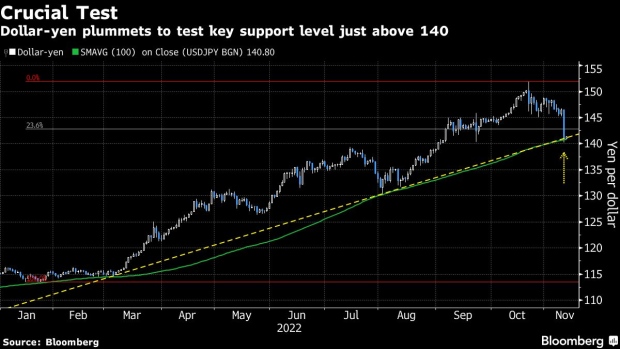

Dollar-yen has tumbled about 4% since its Wednesday close to a cluster of key support levels just above 140, including its 2022 uptrend. A breach would open up the door for further gains for the Japanese currency -- still the year’s worst performer among Group-of-10 peers -- and ease pressure on the government to intervene again to prop it up.

Slower growth in US consumer prices has driven speculation that the Federal Reserve will ease the pace of its rate-hikes, weakening the dollar and pushing down Treasury yields which have weighed on the yen this year.

The yen saw its biggest one-day gain since 1998 on Thursday and fluctuated around 141.20 in afternoon trading in Tokyo on Friday. The dollar came under fresh pressure after China made changes to its Covid-Zero quarantine restrictions.

“Signs have emerged for a change in the yen weakness trend,” said Yukio Ishizuki, senior currency strategist at Daiwa Securities. “In terms of direction, it’s too early to decisively say yen’s weakness has ended, but charts say it’s over.”

Yen Speculators Bow to Japan’s Stealth Strategy as CPI Looms

A widening trade deficit and aggressive US rate hikes driving Treasury yields higher have combined to push the Japanese currency to a 32-year low this year. Japan has spent about 9 trillion yen ($63.5 billion) on interventions in September and October in an attempt to slow the pace of losses.

Finance Minister Shunichi Suzuki kept the door open for intervention Friday, latching onto a lack of US criticism in its latest currency report as evidence there was no problem with Japan’s strategy.

Japan Avoids Rebuke From US, Keeping Intervention Door Open

Ahead of the next Fed policy decision in December, labor market data and another CPI print are due which could still reignite a hawkish stance which would weigh on the yen. But comments from Fed officials after Thursday’s data bolstered bets that the pace of hiking will slow to a 50 basis point rate that month.

“Key is whether dollar-yen at 140 will be supported,” Ishizuki said. “Momentum appears to be building for the pair’s downside.”

(Updates with US currency report, China quarantine news.)

©2022 Bloomberg L.P.