Mar 14, 2022

Wheat Slips as Traders Assess Ukraine-Russia Talks, Rates View

, Bloomberg News

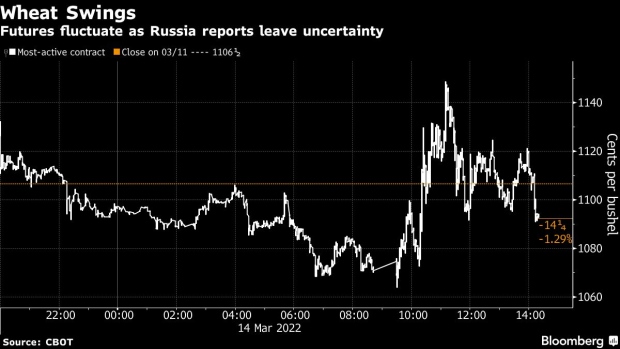

(Bloomberg) -- Wheat futures fell in a broad slump in commodities as markets assessed Ukraine-Russia talks and traders awaited a Federal Reserve decision on U.S. interest rates this week.

Commodities including oil slid as Russian and Ukrainian negotiators are set to continue talks. Meanwhile, the Fed will likely raise rates for the first time since 2018, potentially strengthening the dollar and adding pressure to commodities. Chicago wheat rose as much as 3.8% earlier after Interfax initially reported Russia was considering a wider ban on exports. Interfax later specified the ban would only cover exports to the Eurasian customs union.

“Anything affecting global trade right now is going to get a reaction in the market,” said AgriVisor LLC analyst Karl Setzer. “But the report really paled in comparison to what really affected the market today, which came from concerns over the interest rate hikes.”

Traders are on high alert: Grain exports from Russia had already slowed since the war erupted, with shipowners wary of transiting the Black Sea and a raft of nations imposing financial measures against Moscow. Ports in Ukraine, another heavyweight in grains, are also shuttered, and the threat of massive supply disruptions drove wheat futures to an all-time high earlier this month. Russia and Ukraine together account for about a quarter of world wheat exports.

Still, some grain has been flowing and a formal restriction would leave a hole in global markets. Although Russia is past its seasonal wheat-export peak, it had about 8 million tons left to ship between March and June, the United Nations estimated last week.

“Despite false alarm today, we indeed could see some additional restrictions on exports from Russia in the current season,” Andrey Sizov, managing director of consultant SovEcon, said in a tweet. “Domestic prices in Russia are likely to surge substantially during next week reflecting devaluation of the ruble. And domestic consumers are likely to put a lot of pressure on the government to do something about that during next weeks and months”

Russia’s prime minister last week had warned the country should prioritize its own wheat supplies in order to secure bread for its people as grain prices soar. A host of other nations have also moved to tighten crop exports to ensure domestic supplies, adding to the disruptions for global agriculture trade.

Corn also dropped, falling as much as 3% to $7.40 a bushel.

(An earlier version of this story was corrected to reflect later Interfax story that specified a proposed ban will cover only exports to Eurasian Union.)

©2022 Bloomberg L.P.