Sep 22, 2022

World’s Biggest EV Battery Maker Considers Third Plant in Europe

, Bloomberg News

(Bloomberg) -- The world’s biggest maker of electric-vehicle batteries, China’s Contemporary Amperex Technology Co. Ltd., is considering a third factory in Europe, the company’s president in the region said.

“We are thinking about this, but currently there is no clear decision or activity,” Matthias Zentgraf told Bloomberg News in an interview, saying internal discussions are already underway.

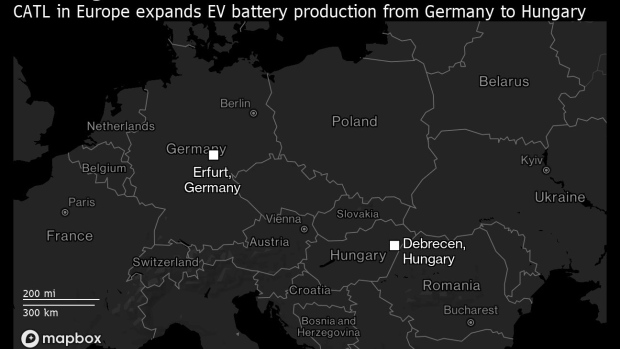

The Ningde, Fujian-based company last month announced plans to build a second European EV battery plant in Hungary, investing 7.3 billion euros ($7.2 billion) in partnership with Mercedes-Benz Group AG. The facility has a planned output of 100 gigawatt hours and will also supply Volkswagen AG, BMW and Stellantis NV. CATL expects it to be ready within five years.

“We will not build a third plant if there is no prospect for the demand volume,” Zentgraf said in a video call from the IAA Transportation conference in Hanover, Germany.

CATL Inks Hungary Land Deal to Start Second Euro Battery Plant

CATL has maintained a lead over rivals, including the world’s second-biggest cell producer LG Energy Solution Ltd. The company rebounded from its sharpest-ever drop in quarterly earnings at the start of 2022, with first-half net income rising 82% from a year earlier and revenue jumping 156%.

CATL has established several production bases in China and subsidiaries in the US, Japan and Europe. It is spending 27 billion yuan ($3.8 billion) on two battery projects in China’s Shandong and Fujian provinces. Zentgraf declined to comment on whether CATL would supply batteries to Tesla Inc.’s new factory in Berlin.

The battery maker has also been looking at sites in Mexico and the US to supply Tesla Inc., Ford Motor Co. and others, though that process has been delayed in part due to political tensions between China and the US, Bloomberg reported in August.

European Energy Crisis

CATL is due to start producing batteries at its first European plant, in the central German city of Erfurt, later this year. One challenge is the continent’s energy crisis and rising gas prices following Russia’s invasion of Ukraine. More than half of Germany’s gas imports came from Russia before the war.

Germany Has Three Months to Save Itself From a Winter Gas Crisis

“We are affected with the shortage of natural gas, which is very important for the cell production process because we need a lot of energy,” Zentgraf said. Gas accounts for about half of the German plant’s energy needs.

“We are working on substitutions for this intensively,” said Zentgraf, who joined CATL in 2015. “We already have a very, very promising idea to replace natural gas to buy renewables.”

Contingency plans will enable the plant to stay operational through winter if gas supplies fall short or prices are too high, he said.

EU Splits Over More Flexible Funding to Boost Cutting-Edge Tech

Zentgraf called for the EU to offer more flexible state aid to help localize and expand the EV-battery supply chain and complement billions of dollars of investment from battery makers.

“Concentrate that subsidy money into building up the supply chain for battery businesses overall,” he said.

(Updates with potential North America plant in seventh paragraph)

©2022 Bloomberg L.P.