Sep 7, 2022

Yen Poses Dilemma for Japan Investor Keen to Buy Treasuries

, Bloomberg News

(Bloomberg) -- For Kiyoshi Ishigane, the yen’s descent to a 24-year low couldn’t have come at a worse time.

The chief fund manager of Mitsubishi UFJ Kokusai Asset Management Co. is looking to increase his holdings of US government bonds from an underweight position. But the weak Japanese currency and a 10-fold surge in hedging costs since the start of the year are making it more expensive to do so.

“It will be too late to eliminate the underweight position” when Treasuries start to rally, said Ishigane, whose company oversees more than $147 billion. But, “hedging costs are troubling when I think about how to do it.”

From a jump in the cost of living to the threat of capital outflows, the impact of the yen’s tumble to the lowest since 1998 is reverberating across Japan’s economy and financial markets. With few signs that a rebound is imminent, authorities on Wednesday issued their strongest warnings to date in an attempt to halt the currency’s slide.

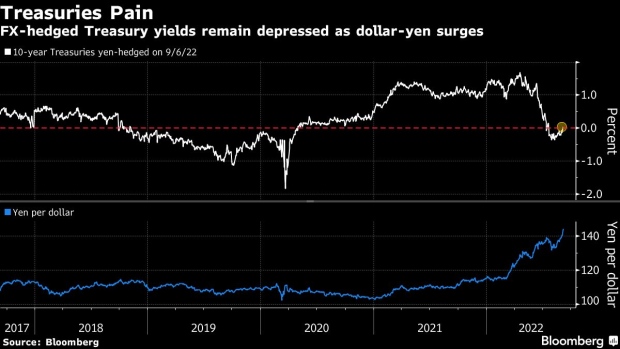

Yen-hedged Treasury 10-year yields rose above zero for the first time since late July this week after Federal Reserve Chair Jerome Powell reaffirmed his commitment to higher rates at Jackson Hole last month. But this has also propelled dollar-yen above 144 for the first time since 1998, making it pricier for Japanese investors like Ishigane to buy US debt with or without currency hedging.

Even after the recent rise, yields on yen-hedged US notes still fall short of those on Japan’s debt, providing little incentive for local investors to venture abroad. Funds in the Asian nation are the biggest overseas holders of Treasuries, and their buying habits have repercussions for the broader US bond market.

Still, some indicators suggest that the yen’s losses may be limited. Conventional valuation measures such as purchasing power parity and real-effective exchange rates all show that the currency is much more undervalued than most of its major peers.

This is line with Ishigane’s experience. He recalls how the currency staged a rapid recovery in 1998 when it surged 18.85 yen per dollar in just a week in October that year, four months after authorities intervened.

“Once the yen starts to rise, it rises really fast,” he said. “The yen usually doesn’t change its course immediately after an intervention, but it tends to do so within a few months.”

(Adds comparison between Japan debt and hedged Treasuries in sixth paragraph)

©2022 Bloomberg L.P.