Bankers Doing Bond Deals Caught Out by New Era of Issuer Clauses

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Joe Biden’s allies are racing to blunt the presidential campaign of Robert F. Kennedy Jr., casting his third-party effort as a stalking-horse bid designed to boost Donald Trump’s chances — even as his wide-ranging policy positions make him a threat to both.

Chengdu, a major city in the southwest China, removed home-buying curbs, joining dozens of peers in the country in an attempt to revive real estate demand and boost economic growth.

China Vanke Co. made a rare response to Moody’s downgrade last week, citing support from financial institutions and its biggest shareholder.

Billionaires who built their fortunes rolling out wireless networks when debt cost almost nothing are seeing their wealth crimped by higher borrowing costs and caution among money managers on the outlook for the industry.

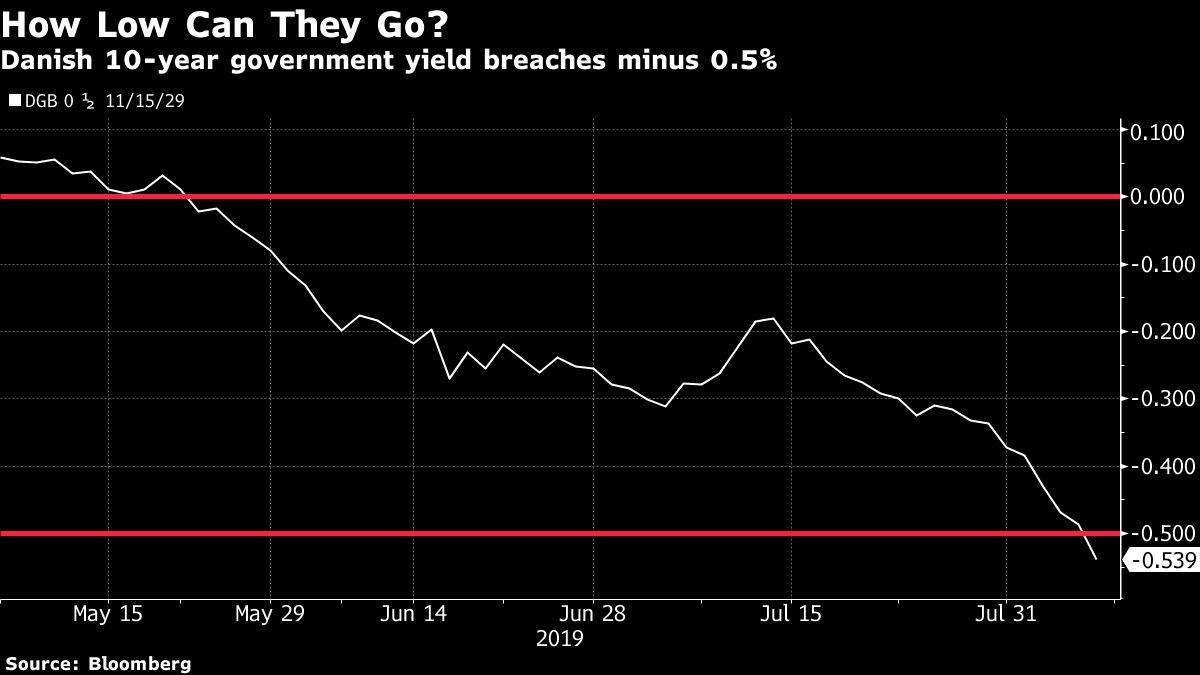

Aug 7, 2019

, Bloomberg News

In Denmark’s US$495 billion mortgage-backed covered bond market, another milestone was reached on Wednesday as Nordea Bank Abp said it will start offering 20-year fixed-rate loans that charge no interest.

The development follows an announcement earlier in the week by Jyske Bank A/S, which said it will start issuing 10-year mortgages at a coupon of minus 0.5 per cent. Danes can also now get 30-year mortgages at 0.5 per cent, and Nordea recently adjusted its prospectus to allow for home loans up to 30 years at negative interest rates.

“It’s never been cheaper to borrow,” Lise Nytoft Bergmann, chief analyst at Nordea’s home finance unit in Denmark, said in an email. “We expect this to contribute to driving home prices higher.”

Though good news for homeowners, Bergmann said the development is “almost eerie.”

“It’s an uncomfortable thought that there are investors who are willing to lend money for 30 years and get just 0.5 per cent in return,” she said. “It shows how scared investors are of the current situation in the financial markets, and that they expect it to take a very long time before things improve.”

NOTE: Realkredit Danmark said on Aug. 2 that it would open a 0.5 per cent, 30-year bond, while Nykredit opened new 30-year, 0.5 per cent on Aug. 5