Nov 15, 2021

An essential alternative for your portfolio: Using options for yield, growth and protection

By Larry Berman

Larry Berman takes your questions

Not a week passes that we do not see a question that reads something like this: “Larry, the yield on my safe money is not keeping up, what do you suggest?”

You cannot replace safe government or investment grade debt with equities. They have very different risks. But you have certainly heard that there is no alternative (TINA) for years now. Learning how to use option strategies can generate the yield, growth, or protection you need with lower degrees of risk than safe fixed-income offers these days.

This week on our weekly BNN Bloomberg Berman’s Call virtual roadshow we will have Chris McHaney portfolio manager from BMO Global Asset Management from the team that manages the BMO Premium Yield ETF (ZPAY, ZPAY/F, ZPAY/U). This ETF seeks to provide exposure to US large capitalization companies, primarily by investing in equities and derivative to provide long-term capital appreciation, generate income, and mitigate downside risks.

I’ve called this strategy the buy low, sell high ETF that pays you about six per cent with about half the volatility of the large cap US benchmark (S&P 500).

- BMO Premium Yield ETF uses option strategies (put-write and covered calls) combined with some long stock exposure to provide an enhanced income product that has less volatility, more diversification, higher yield and partial market exposure

- The portfolio will invest in a concentrated basket of 40-50 large-cap U.S. equities

- Stocks are selected based on quality fundamentals such as strong balance sheets, low debt to equity, high return on equity and liquidity screens

- In normal market conditions, the fund will target a range of 25 to 50 per cent to be invested in equity securities

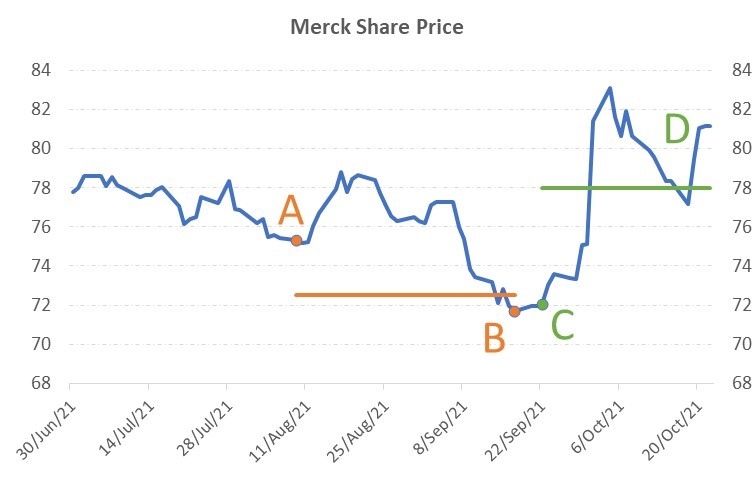

Here is an example of MRK over the past few months:

- In early August at point A: BMO sold a September put option with $72.50 strike; collect $0.85 (1.2 per cent, 11.5 per cent annl.)

The key to this strategy working in the long-run is that you MUST want to own the stock at this price. This is why filtering your potential universe with stronger fundamentals allows us to take advantage of market gyrations.

- At option expiry (third Friday in September) point B: The put option was exercised and ZPAY buys shares for $72.50.

It was actually lower, but we have the obligation to buy it at $72.50. When you sell an option, you are obligated to take delivery at the strike price. i.e. you have to want to own the stock.

- On the next business day point C: BMO sells an October call option with $78 strike; collecting $0.54 (0.8 per cent, 7.7 per cent annl.)

The key here on the target is two-fold. Get that six per cent+ yield target from the option and an additional six per cent on the stock you own.

- At the October options expiry point D, the stock was called away and earned a 7.6 per cent period return.

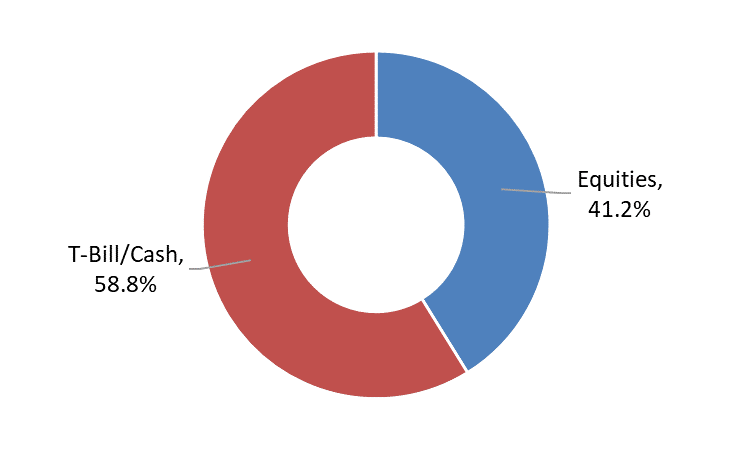

When looking at the ETF, the current holdings can be misleading. It shows a huge amount of cash most of the time. This cash is used as margin requirements for the short options positions to buy the stock if we get put the positions. It can be invested in T-Bills to earn extra yield, though not much these days: Positions at Oct. 22.

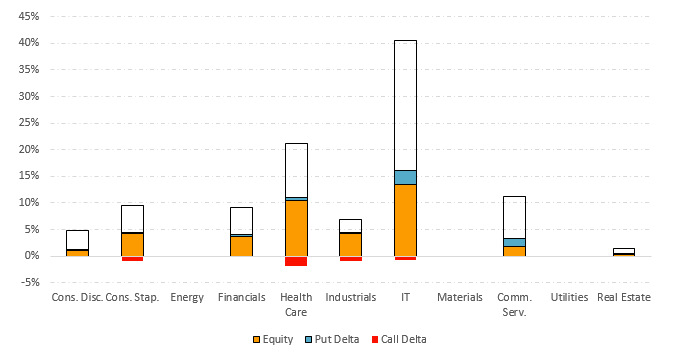

The options risk can be a challenge to understand. The price sensitivity of the underlying portfolio is directly related to how many equities are owned with a covered call and the delta of the put options written. Every wonder what a Gamma squeeze is?

Tune in this week on Nov. 18 at 7 p.m. ET for our Fall 2021 Investors Guide to Thriving Virtual Roadshow where we will take a deep dive with BMO’s Chris McHaney on options strategies used in ZPAY to generate yield, buy low, and sell high. We will also take a look at other option strategies to grow and protect your portfolio. Join us for an evening of demystifying some of the Greek language that scares people away from this increasingly important asset class.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com