Jun 30, 2022

BlackRock’s China ETF Lures Record Cash Amid World-Beating Rally

, Bloomberg News

(Bloomberg) -- Investors are piling into the largest US listed exchange-traded fund tracking Chinese stocks, as loosening virus restrictions and an easing regulatory crackdown attract buyers to a market deemed “uninvestable” by some just months ago.

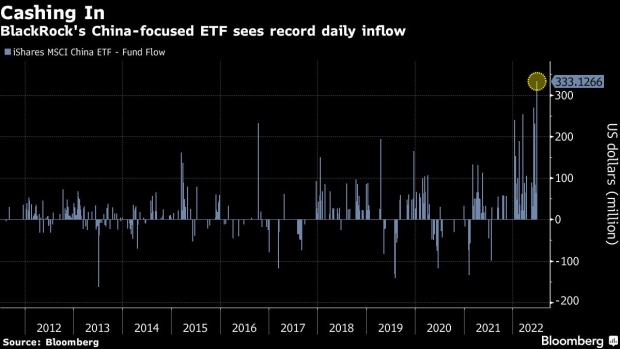

The iShares MSCI China ETF (ticker MCHI) lured $333 million on Wednesday, its largest single-day inflow since the fund’s inception in 2011. The $8.5 billion ETF, which mostly invests in shares of Chinese companies listed in Hong Kong, finished the month up almost 8% Bloomberg data show.

As central bankers around the world raise interest rates to tamp down rising inflation, stocks have paid the price. Fears of a looming recession sent US shares down 21% in the first six months of 2022-- their worst first half since 1970, while European stocks had their worst start to the year since the global financial crisis. Chinese shares, in contrast, have surged in recent weeks, as policy makers dial back months of stringent virus curbs, deleveraging efforts and punishing regulatory and antitrust campaigns against the private sector.

“It speaks to the bottom fishing going on, and the desire to allocate to any asset that is actually going up in this environment,” said Todd Sohn, an ETF strategist at Strategas Securities. “China is basically zigging, while global equities zag.”

Whether the recent rally can continue remains uncertain, Sohn said, particularly if the country dials back its moves to ease Covid-19 restrictions.

Still, most investors remain upbeat. A recent Bloomberg survey of 19 fund managers and analysts shows that they expect benchmark stock gauges in China and Hong Kong to post gains of at least 4% by year-end, outperforming their global peers.

As for MCHI, it hasn’t seen a single day of redemptions this year. In fact, four out of the five largest one-day flows into the fund have occurred in 2022, according to Bloomberg Intelligence’s Anthony Rayar.

(Updates to market close beginning in third paragraph)

©2022 Bloomberg L.P.