Aug 30, 2021

Buenos Aires Province to Restructure 98% of Bonds in Debt Deal

, Bloomberg News

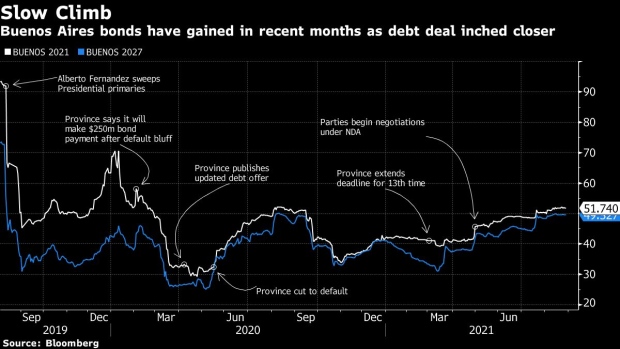

(Bloomberg) -- Argentina’s Province of Buenos Aires says it received creditor support to restructure 98% of its $7.1 billion in overseas debt, putting it a step closer to ending a 16-month default.

The province, which is Argentina’s largest and most populous, will swap all of the bonds it had offered to exchange except for dollar-denominated notes due 2021 and euro-denominated bonds due 2020, which had been issued under indentures that required a higher amount of creditor participation, according to a statement. The deal is expected to settle Sept. 3.

The results cap Argentina’s most recent round of debt restructurings, after nearly every province reached deals with bondholders over the past 12 months and the national government restructured its own $65 billion in securities a year ago. The exchange, which was designed to dissuade creditors from holding out, also marks a success for Buenos Aires Governor Axel Kicillof, known for butting heads with investors as Argentina’s economy minister during its 2014 restructuring.

“This agreement allows for financial relief of $4.6 billion until 2027,” Province Economy Minister Pablo Lopez said at a press conference. “This will give room to the province to invest in infrastructure and social needs.”

The province’s new bonds mature in 2037 and are valued at about 51 cents on the dollar. Creditors who accepted the deal will also receive a 10% cash payment of interest accrued during default, and the remaining 90% will be tacked onto the bonds’ principal.

Home to almost 18 million people and accounting for two-fifths of Argentina’s gross domestic product, Buenos Aires has been in default since April 2020. On Aug. 26 the province said it received support from holders of more than 90% of its bonds, including GoldenTree Asset Management, its largest creditor.

©2021 Bloomberg L.P.