Feb 28, 2022

Chaos in commodities as Russia’s war on Ukraine upends trade

, Bloomberg News

During big geopolitical events, markets drop 5% and recover in about 47 trading days: Strategist

The turmoil unleashed in commodity markets by Russia’s invasion of Ukraine worsened on Monday as LNG orders were paused, finance for trade in raw materials dried up and Black Sea wheat sales froze.

As tougher U.S. and European sanctions threaten to partly cut Russia off from the global financial system, disruptions to shipments of raw materials from palladium to wheat mounted. Buyers also paused purchases of Russian liquefied natural gas as they awaited clarity on restrictions against banks and companies. The cost of shipping the nation’s raw materials is soaring, while the fallout is reverberating from London to Hong Kong as international investors ditch Russian commodities assets.

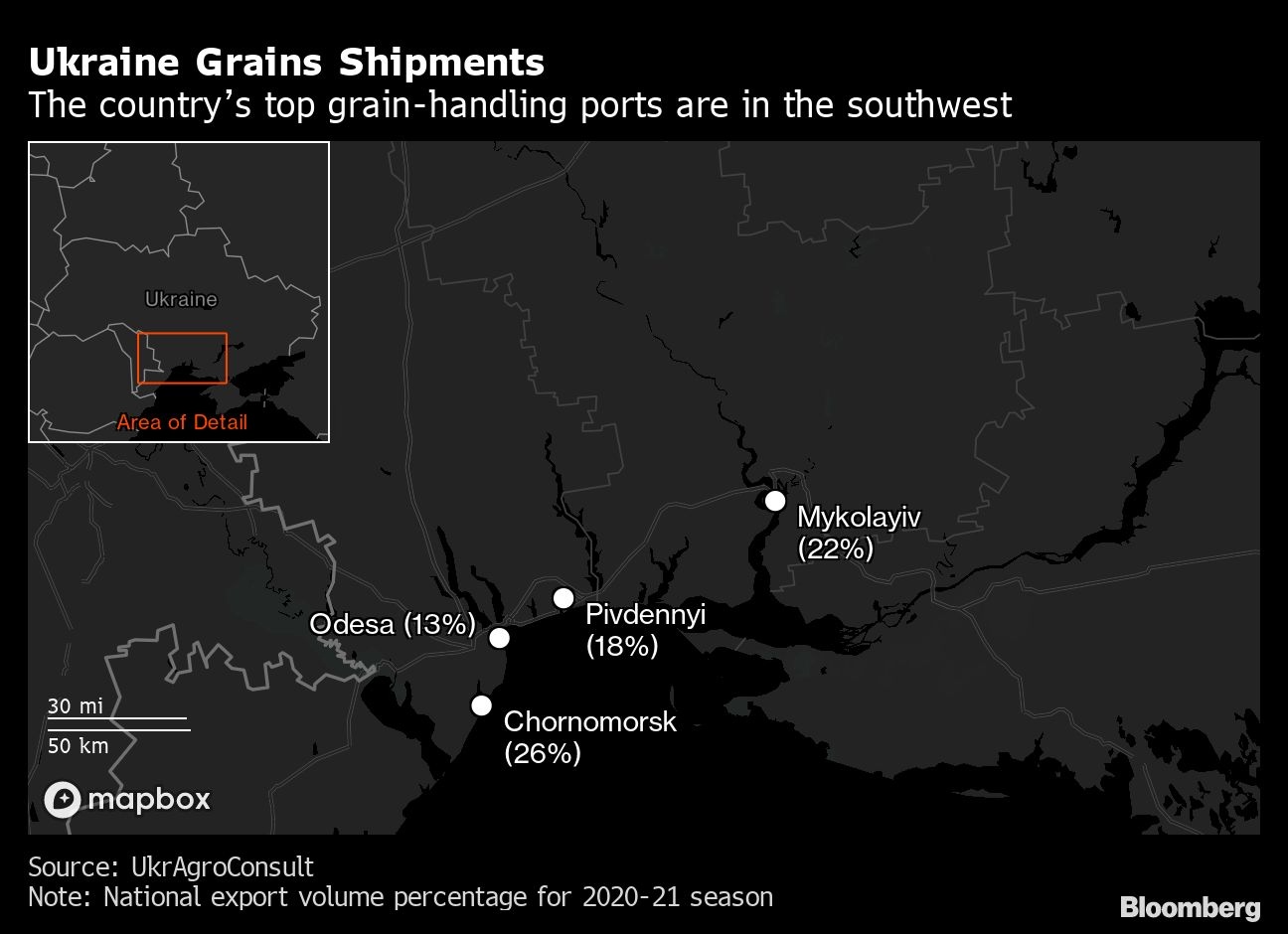

The immediate focus is on disruption to Black Sea trade, which includes millions of barrels of oil a day and about a quarter of the world’s grain exports. While Russian raw materials were so far exempted from sanctions, the threat of a severe dislocation to flows will increase as the conflict escalates.

“Unintended consequent risk, meaning a pipeline outage or something like that, is extraordinarily high, and this is on top of the difficulty of getting the seaborne trade up and running,” Jeff Currie, head of commodities research at Goldman Sachs Group Inc., said in an interview with Bloomberg TV. “This is an enormous amount of oil that has the potential to be disrupted for weeks.”

Even before the expulsion of some Russian banks from the SWIFT messaging system -- used for trillions of dollars worth of transactions around the world -- a number of lenders were halting the finance of commodities trading from Russia.

Societe Generale SA and Credit Suisse Group AG have stopped providing trade finance for Russian raw materials flows, according to people familiar with the matter. Dutch banking giants ING Groep NV and Rabobank are restricting lending to deals involving movement of commodities from Russia and Ukraine, and Chinese banks are also pulling back.

That means that even without sanctions, many of the commodity markets in which Russian exports play a significant role at are risk of seizing up. As the war intensifies -- with ships bombarded last week -- the risk of logistical turmoil is also increasing. Insurers are either refusing to offer cover for vessels sailing into the Black Sea, or demanding huge premiums to do so.

Grain loading in Ukraine has been halted with ports closed. More than two dozen vessels in the midst of loading have been held up at Ukrainian ports, according to Nabil Mseddi, chief executive officer of AgFlow.

Top wheat importer Egypt was forced to yet again ditch efforts to buy the grain it needs to subsidize bread for its people, highlighting the threat that the Russia-Ukraine war poses to the world’s food needs. There were no offers from Black Sea shippers and Egypt’s state buyer cited higher prices for the tender cancellation.

Benchmark wheat futures jumped 8.6 per cent in Chicago, the biggest single-day gain in more than 11 years, and 8.9 per cent in Paris. Corn climbed 5.3 per cent and soybeans 3.3 per cent.

However, there are signs of oil traders starting to overcome an initial wariness of dealing with Russian supply that emerged immediately after the invasion.

Poland’s PKN Orlen bought a consignment of the nation’s flagship Urals crude, while Trafigura Group provisionally hired a tanker to take the same grade. Traders said there was increased buying activity. That’s not to say that the market has fully returned to normal, with a tender to sell Urals failing to proceed for a second time.

TOXIC INVESTMENTS

Vladimir Putin’s attack on his neighbor is also threatening to make Russian commodities toxic for international investors. Norway said it was starting to remove Russian assets from its US$1.3 trillion sovereign wealth fund, while BP Plc dropped after saying it would offload its stake in state-owned oil company Rosneft PJSC.

While equity trading was halted in Moscow, MMC Norilsk Nickel PJSC, Russia’s biggest metals and mining company, slumped as much as 58 per cent in London and closed 43 per cent lower. In Hong Kong, aluminum giant United Co. Rusal International PJSC fell 16 per cent.

Rusal halted shipments at a Ukraine alumina refinery that’s a key source of raw material for its smelters in Russia. Ukrainian iron-ore miner Ferrexpo Plc said Monday the availability of rail capacity to ship its pellets to customers in Europe was unclear. The London-listed company, which operates three mines in central Ukraine, said it’s delaying the publication of its full-year results.

RISKY BUSINESS

There are sanctions’ carve outs for Russian raw materials, but traders, banks and shippers fear those exemptions may not last.

“Commodity markets need to reflect not only these difficulties in paying for Russia’s exports but, with little left to sanction, the risk that Russian commodities eventually fall under Western restrictions,” Goldman analysts including Damien Courvalin and Currie said in a note dated Feb. 27.

The White House isn’t ruling out a further extension of sanctions.

“Energy sanctions are certainly on the table,” said White House Press Secretary Jen Psaki, speaking on ABC’s “This Week” on Sunday.

European natural gas surged as much as 36 per cent before paring gains, as the new round of sanctions spurred concerns about energy shortages. With Russian markets paralyzed and heavy fighting reported around key cities in Ukraine, Putin’s invasion looks set to underpin many commodities for some time.

“This reinforces that longer-term structural bull market in commodities,” said Currie.