Mar 14, 2024

China Drains Cash Via Key Funding Tool for First Time Since 2022

, Bloomberg News

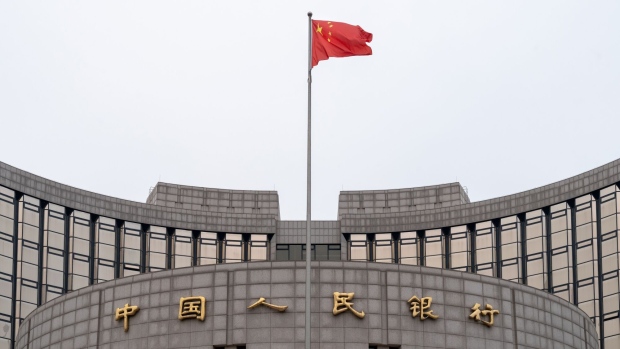

(Bloomberg) -- China drained cash from the banking system with a medium-term liquidity tool for the first time since November 2022, extending its cautious approach of using monetary policy to boost growth and showing its willingness to support the yuan.

The People’s Bank of China withdrew 94 billion yuan ($13 billion) of cash from the banking system on a net basis to avoid excessive liquidity, while it kept the rate on its one-year policy loans steady at 2.5% on Friday. Earlier today, Beijing set its daily reference rate for the yuan, with the largest strong bias to the Bloomberg-survey estimate since November.

The rate decision will likely disappoint investors and economists who anticipate more stimulus is needed for the government to achieve its ambitious economic growth target of around 5% for this year. It also underscores the PBOC’s limited scope in further easing monetary policy — given a wide US-China interest rate differential — before the Federal Reserve’s policy pivot.

The Chinese yuan was steady both onshore and offshore after the stronger fixing support. Yield on 10-year government bonds fell one basis point to 2.34%, still at the lowest level in two decades. Chinese onshore equities declined, with the CSI 300 Index losing as much as 0.8%. The Hang Seng Index in Hong Kong dropped as much as 2.1%.

Investors have been expecting rate cuts in China this year as the world’s second largest economy struggles with deflationary pressures, a years-long property crisis and sluggish demand. The US-China rate differential also has hammered its currency and exacerbated capital outflows amid a weaker-than-expected economic recovery.

“We expect there is limited room for PBOC policy easing before global central banks start to cut rates, as yuan stability remains a policy objective and further widening the interest rate spread with a rate cut would add to depreciation pressure,” said Lynn Song, Chief Economist for Greater China at ING. The central bank may reduce reserve-requirement ratio in coming months before slashing the rates on MLF, he said.

The Chinese yuan has fallen around 1% so far this year despite consistent support by the authorities, as expectations of a Fed rate cut as early as the first quarter have been rolled back due to resilient US inflation. Investors’ bets on more easing in China boosted their frenzy over the nation’s sovereign debt, driving yields to around two-decade low.

Chinese authorities will likely want to gauge the effect of previous stimulus before further actions, especially given that the most important annual political event just wrapped up in Beijing earlier this week. A slew of economic data releases next Monday — including fixed-asset investment, retail sales and industrial production — will provide more clues on economic conditions.

The country’s economy has shown nascent signs of recovery, with consumer prices rising in February for the first time since August and exports beating market estimates. Proof of a more sustainable trend will require more solid data in the coming months.

The PBOC is leaning on measured and targeted monetary policy in buoying economic growth. But its push to lower financing costs has been conspicuous. Last week, PBOC Governor Pan Gongsheng hinted at a further reduction of banks’ reserve requirement ratio, the amount of cash banks have to keep in reserve. In January, he also telegraphed the previous surprising cut that came days later.

Chinese banks also cut the five-year loan prime rate - a key reference rate for mortgages - by the most on record in February.

(Updates with stock price in fourth paragraph. Earlier version corrected PBOC’s action in second deck headline.)

©2024 Bloomberg L.P.