Aug 4, 2022

China State-Backed Builder’s Dollar Bonds Slump as Worries Mount

, Bloomberg News

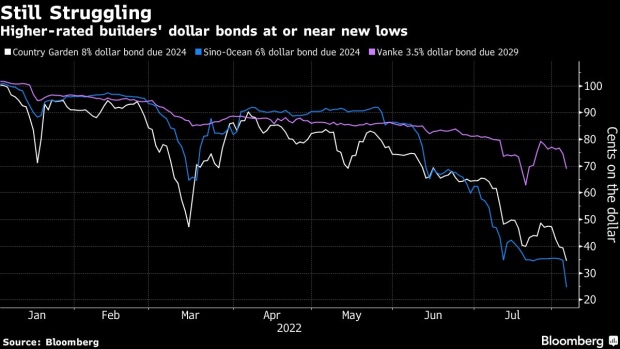

(Bloomberg) -- Dollar bonds of a state-backed Chinese builder fell by record amounts Thursday, following several months of declines as repayment worries have circled even developers partially owned by the government.

Some notes issued by Sino-Ocean Group Holding Ltd. dropped about 10 cents on the dollar, according to Bloomberg-compiled prices, putting most in deeply distressed territory at below 25 cents. The firm led weakness among other higher-rated builders, with bonds from China Vanke Co. and Country Garden Holdings Co. poised to notch their biggest declines in weeks.

Thursday’s selling in dollar bonds of Sino-Ocean, China’s 20th-largest builder by contracted sales, came as an onshore note from an affiliated company plunged a record 28% Thursday. Holders of that 1 billion yuan ($148 million) bond are able to demand that they be repaid next month.

Sino-Ocean’s offshore notes have steadily dropped since late May, when peer Greenland Holdings Corp. rocked China’s credit market by seeking a payment extension. That request, which bondholders approved, raised fresh doubts about the financial strength of builders with state ownership as new-home sales have continued to plunge and most firms’ financing channels remain constricted.

More recently, China South City Holdings Ltd. got approval to extend its $1.57 billion of dollar bonds barely two months after a state entity bought a 29% stake in the developer.

Sino-Ocean was downgraded from investment-grade territory on Monday by Moody’s Investors Service, which predicted the builder’s 2022 contracted sales will fall about 25%. In the credit rater’s report, analyst Cedric Lai cited expectations that support from China Life Insurance Co., Sino-Ocean’s largest shareholder, “will reduce over time as the deterioration in China’s property market would reduce Sino-Ocean’s economic and strategic importance to China Life.”

©2022 Bloomberg L.P.