Oct 16, 2022

China Traders See Tech Focus, More Covid Gloom After Xi’s Speech

, Bloomberg News

(Bloomberg) -- President Xi Jinping’s two-hour address to the party congress on Sunday left traders poring over the nuance of each phrase as China’s leader ranged from Taiwan to semiconductors, pollution, housing and the coronavirus.

Those expecting a shift away from the Covid Zero policy that has weighed on the economy were disappointed, but there were strong comments in specific areas, such as technology, the environment and national security, that could indicate support in some market sectors. Overall though, Xi did little to lift the gloom that has encompassed China’s markets in the lead-up to the five-yearly leadership meeting.

“In the short term, it seems that there will not be any change in the direction of Covid Zero policy, which will drag on market sentiment,” said Shen Meng, a director at investment bank Chanson & Co. in Beijing.

Market watchers were looking especially for indications of support for the nation’s troubled property industry and the technology sector, which recently came under assault from the US.

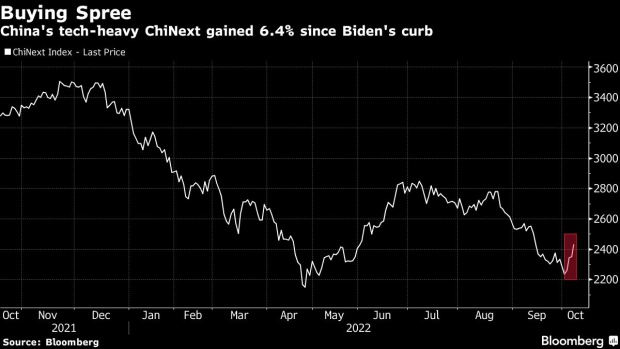

Earlier this month, the US Commerce Department unveiled sweeping regulations that limit the sale of semiconductors and chip-making equipment to Chinese customers, striking at the foundation of Xi’s efforts to build a domestic chip industry. Xi hit back in the speech on Sunday, promising to “resolutely win the battle in key core technologies,” and investors could be trading on expectations that more supportive policies will come.

“There was a lot of emphasis on technology and innovation,” said Peiqian Liu, chief China economist at Natwest Markets. “Which means the focus will likely shift away from just lowering financial risks and reducing debt growth to pouring more resources into development of high tech.”

Saber-rattling between the US and China over security issues such as Taiwan could also heighten interest across a number of industries after Xi emphasized the need for self reliance.

“National security is key,” said Hong Hao, partner and chief economist at Grow Investment Group. “This is why last week the ChiNext had a strong bounce. The market believes more investments will be poured in.”

Missing Slogan

A glimmer of light was offered to the pummeled property sector, which has suffered a yearlong crisis, not so much by what Xi said as what he didn’t say. Absent from his address was the slogan of “housing is for living, not for speculation,” spurring hopes of further easing of pain for developers. Still, the slogan later reappeared in the state media’s full transcript, indicating the difficulty in reading the tea leaves when it comes to Party gatherings.

“This slogan, along with the crackdown on real estate sector, may not be the party’s focus in the near-term,” said Ting Meng, senior Asia credit strategist at ANZ Bank China Co. “There may be continued policy support to boost home sales, although it’s unlikely for authorities to aid private developers’ debt directly or rein in defaults.”

Green Debt

The environment, a long-time passion for Xi, also garnered strong rhetoric, though how his reaffirmed support for cutting emissions will play out on the nation’s murky green bond market is unclear.

“The commitment to tech and green sectors looks strong, meaning these sectors are the rare darlings with favorable government policies,” said Gary Ng, senior economist at Natixis.

The Shanghai Composite Index lost more than 5% over the past month, its worst pre-Congress showing since the gauge’s inception in 1991. The yuan is down more than 10% this year against the dollar, heading for the worst annual performance since 1994. China’s dollar-denominated junk bonds have plunged to near record lows as a property crisis expanded.

Investors including Chanson’s Shen point out that the speech to congress tends to give the broade strokes of party direction and many traders will be looking for more detailed signals to help fill in the detail over the coming weeks.

Covid Zero “will still be the biggest drag for market sentiment and economic growth, but it is possible to see a softer stance on properties, at least in the short run,” said Ng. “The market may be excited only about certain sectors due to the limited changes in the overall tone and the growth prospect. But the biggest worry is whether the tightened grip of the state will affect the business opportunities in China, further amplifying the polarization between state-owned and private firms.”

©2022 Bloomberg L.P.