Feb 21, 2021

Dividend ‘Supercycle’ May Kick Off for Australia’s Biggest Firms

, Bloomberg News

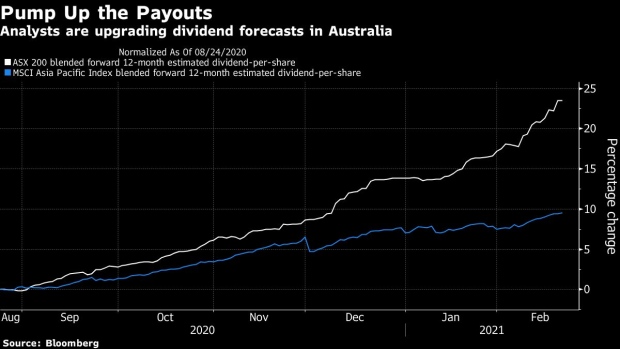

(Bloomberg) -- Australian dividend payouts are exceeding analysts expectations in the current earnings season, which could support the nation’s stocks and usher in years of amped-up payments.

“With operating conditions improving across sectors, boards have started re-instating more generous payout ratios” as earnings beats surpass misses, JPMorgan Chase & Co. analysts wrote in a Feb. 19 note. “We believe an Australian dividend supercycle is in the offing,” led by value sectors like banks and miners, which comprise the bulk of the S&P/ASX 200 Index.

Australia is known for being a traditionally high dividend-yielding market, but saw aggressive cuts to payout forecasts as the nation’s firms slashed or withheld payments to preserve cash during the coronavirus pandemic. Expectations for a rebound among the heaviest-weighted sectors on the benchmark this year could potentially boost the gauge’s appeal.

Banks, Miners to Lead Dividend Resurgence Among Australian Firms

About 85% of companies reporting half-year results so far have issued a dividend, Commsec Chief Economist Craig James wrote in a Feb. 22 note, adding that aggregate dividends are up 4% on a year ago. Corporate Australia is in “good shape with strong balance sheets being maintained” amid a faster-than-expected economic recovery, he said.

Australian Corporates Have ‘Mojo Back,’ Looking to Take on Risk

Banks, the benchmark’s biggest constituent, have been the “star” of earnings season with lower bad debts driving earnings upgrades, according to Macquarie Group Ltd. Commonwealth Bank of Australia, the nation’s largest lender, increased its dividend payout even as profit declined, heralding higher payments from the nation’s other three large banks this year.

Miners have also impressed this earnings season. Iron ore producers Rio Tinto Ltd. and BHP Group Ltd. declared record payouts amid a boom in metals prices.. The firms are among the seven stocks on JPMorgan’s list of preferred dividend plays, the broker said.

©2021 Bloomberg L.P.