Apr 8, 2022

Dollar Surges to Highest Since Mid-2020 as Treasury Yields Jump

, Bloomberg News

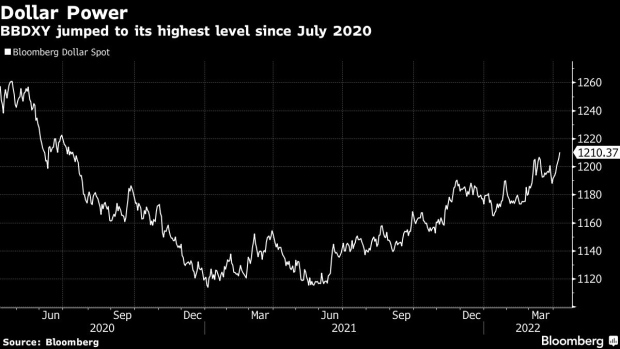

(Bloomberg) -- A gauge of the U.S. dollar’s strength climbed to its highest level in close to two years as Treasury yields continued to jump Friday, with traders bracing for an aggressive series of interest-rate hikes from the Federal Reserve.

The Bloomberg Dollar Spot Index rose 0.4%, eclipsing the previous high for 2022 and reaching a level unseen since July 2020. The dollar advanced against most of of its peers, with some of the biggest gains coming against the Australian and New Zealand currencies.

The dollar has been buoyed this year as expectations for tighter Fed policy pushes up Treasury yields, with those on 10-and 30-year both hitting roughly three-year highs Friday. Concern about the Russia-Ukraine war has fueled demand for the greenback, which is typically seen as an investment haven during times of turmoil.

“Regardless of the new Covid strain and the war on Ukraine and supply chain issues and all this other stuff, the U.S. is still on fire,” said Brad Bechtel, a strategist at Jefferies LLC, speaking to the dollar’s relative strength compared with other currencies. “It feels like the U.S. is sort of pulling away from the rest of the world.”

©2022 Bloomberg L.P.