Jun 30, 2023

Euro-Area Core Inflation Quickens Again in Setback for ECB

, Bloomberg News

(Bloomberg) -- Euro-area core inflation re-accelerated in June, a setback for the European Central Bank that may reinforce its determination to raise interest rates next month.

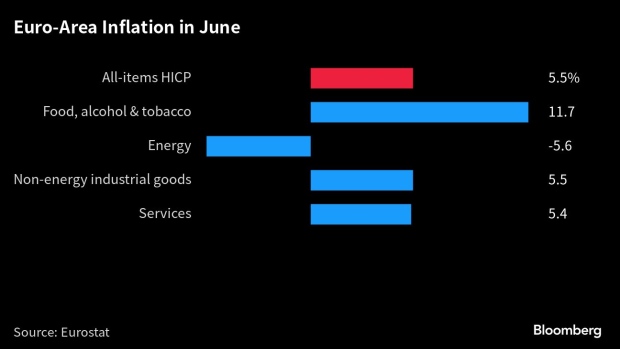

The measure of underlying consumer-price gains, which excludes items like fuel and food, came in at 5.4% — just below the median estimate in a Bloomberg survey of economists — as the cost of services picked up markedly.

The deterioration may eclipse an improvement in the headline inflation gauge. That moderated noticeably to 5.5% from 6.1%, reaching the lowest level since before the war in Ukraine broke out, after energy costs fell.

The data, released hours before numbers that may show the US Federal Reserve’s preferred price metrics stayed elevated in May, illustrates the continued slog for global central bankers.

Frankfurt policymakers’ tightening campaign will soon mark its first anniversary. Another rate increase in July is a “fait accompli,” according to ECB Vice President Luis de Guindos, who says the prospect of a move at the subsequent meeting in September is an open question.

What Bloomberg Economics Says...

“Base effects and statistical distortions are likely to keep the core reading elevated over the next couple of months and see the ECB hiking at least until September. But if some of the early signs of easing price gains in services are confirmed, they could give the doves on the Governing Council more ammunition to call for a pause after the July meeting.”

—Maeva Cousin, senior economist. For full note, click here

“While we do not currently see a wage-price spiral or a de-anchoring of expectations, the longer inflation remains above target, the greater such risks become,” the institution’s president, Christine Lagarde, said Tuesday. “We need to bring inflation back to our 2% medium-term target in a timely manner.”

Euro area bonds held onto earlier declines after the data were published, and bets on the ECB’s peak rate were little changed at 4%. The 10-year bund yield was around 3 basis points higher on the day, at 2.44%.

National numbers this week from across the 20-member euro area showed Spanish inflation below the ECB’s 2% target, while France, Italy and the Netherlands all saw a retreat, albeit well above the goal.

But German consumer-price growth quickened to 6.8%, driven largely by an ultra cheap public-transport ticket the government offered last year to help citizens deal with surging energy costs.

Speaking at the European Union summit in Brussels, German Chancellor Olaf Scholz said his government’s efforts to diversify energy supplies away from Russia have helped dampen inflation “even if prices are not yet where we want them to be.”

“It’s very important that we never lose sight of the goal of price stability, we owe that to citizens,” he said.

Data published Friday that showed a decline in German import prices in May of 9.1% compared with a year earlier is a positive sign and should slow the headline inflation rate down the line, Scholz added.

That stoked a pickup in services inflation there, feeding an acceleration across the region. The euro-zone measure of price growth in that category quickened to 5.4% in June from 5% the prior month.

With inflation initially driven by shocks including the pandemic and Russia’s war in Ukraine, concerns now center around strong demand for services such as travel, and accelerating wage gains to make up for lost income.

Such worries are increasingly troubling policymakers after a historic tightening campaign that has seen 400 basis points of hikes in borrowing costs.

Several officials speaking at the ECB’s annual retreat in Sintra, Portugal this week underscored their focus on underlying inflation, saying that a slowdown must materialize before they can pause rate increases.

Another hike beyond July would bring the ECB’s deposit rate to 4%. Officials have also said that once borrowing costs reach a peak, they will stay there for an extended period to get consumer price pressures under control.

--With assistance from Barbara Sladkowska, Joel Rinneby, Alice Gledhill, Arne Delfs and Iain Rogers.

(Updates with Scholz starting in 10th paragraph.)

©2023 Bloomberg L.P.