Oct 10, 2022

European Gas Prices Drop to 3-Month Low Amid Strong LNG Imports

, Bloomberg News

(Bloomberg) -- European natural gas finished mildly lower on Monday after wild price swings caused by an escalation of Russia’s war in Ukraine.

Kyiv said it will stop electricity exports to western neighbors due to Russian attacks on its energy facilities. While the statement from the Ukrainian energy ministry didn’t mention gas-transit infrastructure, initial reports caused a sharp spike in prices, with benchmark futures jumping as much as 20%. Prices quickly eased, settling at the lowest level in more than three months.

President Vladimir Putin threatened further missile strikes on Ukraine after Russia hit Kyiv and other cities in the most intense barrage of attacks since the first days of the invasion. For now, shipment orders indicate that gas transit through Ukraine is expected to be stable on Tuesday, based on data from the nation’s grid.

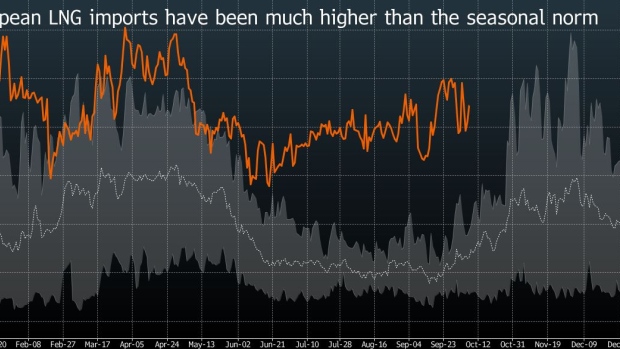

Still, Monday’s roller-coaster session was a stark reminder of how volatile the market is, even though Russia has already cut its gas supplies to Europe to just a fraction of what it used to ship, and the continent is coping. Record imports of liquefied natural gas, mainly from the US, have helped the region to fill its winter stockpiles to nearly 91%, which have eased some nerves recently and helped keep prices in check.

Dutch front-month futures, the European benchmark, settled 1.3% lower at 154.12 euros per megawatt-hour, the lowest level since July 1. The UK equivalent slipped 0.6% after briefly rising as much as 22% earlier.

Many traders have already assumed that the little gas Europe is still getting from Russia via Ukraine might come to a halt at some point, said Tom Marzec-Manser, head of gas analytics at ICIS in London. But the escalation of the war is still fueling brief spikes in prices. “The events we are seeing could be playing a part in higher risk premium being added back in, in case of pipeline collateral damage,” he said.

Meanwhile, the market is also waiting to see if the European Union governments come up with credible measures to ease the crisis.

An advisory group to the German government on Monday recommended that the state spend almost 100 billion euros into 2024 to subsidize most gas consumption by households and industry. Officials are expected to issue a decision in the coming weeks.

EU leaders will discuss further steps later this month, but are unlikely to reach an agreement then. The Czech presidency of the block is planning an extraordinary energy council in November to help reach a deal on new measures to bring down gas prices, according to a senior official.

©2022 Bloomberg L.P.