Feb 3, 2023

European Stocks Set for Bull Market on Rates, Growth Optimism

, Bloomberg News

(Bloomberg) -- Europe’s benchmark stock index was set to enter a bull market as investors bet on a combined boost from resilient economic growth and a potential easing in central bank policy.

The Stoxx 600 Index gained 0.06%, briefly bringing total gains from a low on Sept. 29 to 20%. If the index closes at or above that level, it will confirm a technical bull market.

Other European indexes including France’s CAC 40, Germany’s DAX and the blue-chip Euro Stoxx 50 are already in that territory as investors have turned more optimistic about the region’s assets. A milder-than-expected winter and resilient growth indicators have also raised bets that the damage from a slowdown in growth won’t be as bad as feared.

Data today showed the US economy added more jobs than expected in January. Investor sentiment has also been boosted this week following remarks from Federal Reserve Chair Jerome Powell that price pressures were cooling, fueling bets around easing financial conditions in the coming months. The European Central Bank, meanwhile, raised rates by 50 basis points, but some market participants said the central bank’s policy outlook was encouraging.

“I read the ECB’s statement as rather dovish,” said Andrea Tueni, head of sales trading at Saxo Banque France. “If one reads between the lines, it could suggest that the ECB could be looking for an excuse to revise the pace of tightening.”

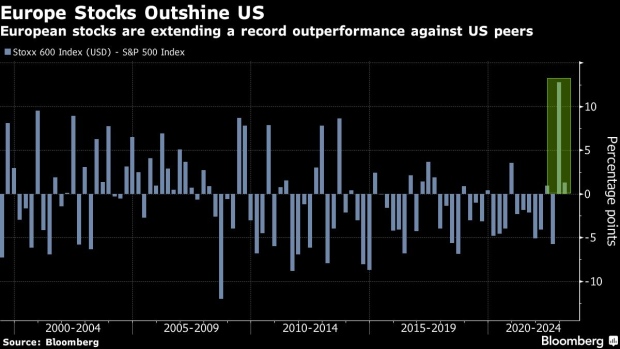

Meanwhile, market strategists including at Goldman Sachs Group Inc. have said European equities have the potential to extend an outperformance against US peers, helped by cheaper valuations. The Stoxx 600 is now up 32% in dollar terms since the end of September, compared with a 17% increase in the S&P 500.

Read More: European Assets Are Now All the Rage as US Markets Sputter

“We do expect Europe to continue to do much better compared to US equities,” said Benjardin Gaertner, head of equity portfolio management at Union Investment, a German asset manager with 406.9 billion euros ($445 billion) under management. He cited attractive valuations in Europe as well as the US’s reliance on growth-linked technology stocks, which tend to be particularly hurt by higher interest rates.

The next big test will come from corporate earnings as companies grapple with elevated costs at a time when consumer demand is slowing. Morgan Stanley strategists said they were seeing “a clear loss of momentum” in the share of European firms beating profit and sales estimates. If the pace was maintained, it would be the weakest showing in two years, they wrote in a note on Friday.

--With assistance from Julien Ponthus.

©2023 Bloomberg L.P.