Aug 5, 2022

Exotic Bond Issuers Flee to Private Markets as Uncertainty Swirls

, Bloomberg News

(Bloomberg) -- Companies that issue exotic bonds are having a tough time getting deals done as macro-economic uncertainty rises and investors seek refuge in plain vanilla transactions. So, they are turning to a more traditional ally: private debt.

Borrowers in the esoteric ABS market repackage unusual assets into securities -- ranging from royalties to aircraft and shipping containers -- as opposed to conventional debt like credit cards or auto loans.

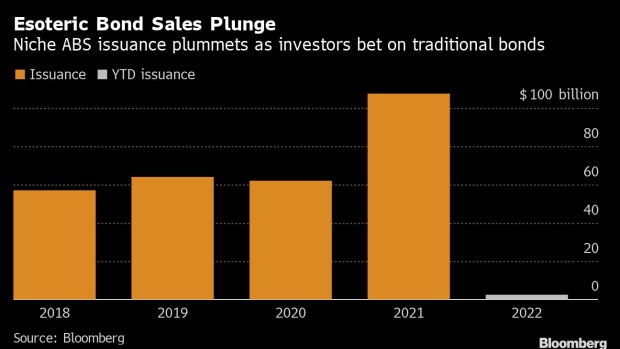

While overall non-traditional ABS is up year to date from last year, it’s not happening in all pockets of the esoteric market. There have been just two aircraft ABS sale -- including those backed by commercial and business aviation -- compared to eight at this point last year. And in whole business deals, there’s also been a decrease, with ten deals pricing year to date, compared to 14 at the same time last year.

As uncertainty settles in, most esoteric borrowers have been seeking out private partnerships instead. “In public markets there’s a lack of certainty around pricing,” said Yezdan Badrakhan, head of esoteric ABS at MUFG, in an interview. “Bank-led deals provide that certainty.”

Investment banks have reportedly been quick to jump in, providing issuers with bridge financing, term loans or increases in warehouse facilities to make up for the risk-off sentiment in the public markets. Separately, borrowers are also pursuing bilateral deals, such as private placements with investors they already have a relationship with, according to market participants.

Meanwhile, both traditional and non-traditional issuers which managed to bring deals to fruition the conventional way saw spreads widen as the market priced in uncertainty. In May, a commercial mortgage bond deal backed by debt linked to The Cosmopolitan of Las Vegas cheapened by as much as 100 basis points on the lower tranches.

The surge in borrowing costs due to rising rates and investors asking for juicier terms has deterred companies in the esoteric ABS sub-sector from bringing more deals to market. In June, Carlyle Aviation Partners paid a coupon of 6% on the only tranche of its roughly $522 million aircraft deal, about double what it paid for a similar deal in November, where the coupon was 2.95% on the largest tranche. The bond was backed by leases with companies like InterGlobe Aviation Limited, Spirit Airlines Inc., Air Canada and Avianca.

The slower book building as a result only serves to exacerbate the situation. “One of the worst things that can happen for an investor in a deal is to get investment committee approval to do a transaction that ultimately fails due to lack of a demand,” said Rich Barnett, a partner leading the capital markets team at Castlelake LP, in an interview.

In contrast, private market lenders can skip time-consuming roadshows and arrange terms directly with issuers that won’t change in line with market fluctuations.

For esoteric issuers, tapping bank lines is also a way for the companies to prove to investors they are here for the long-run. “We believe one of the reasons they are turning to private markets is to show investors that they are a survivor and still have access to capital,” said Barnett.

From the banks’ perspective, the shift is an opportunity to build on relationships as well, said Badrakhan.

Yet, it is unlikely that the momentum will last. “They’ll go back to the structured markets,” said Badrakhan. “They are not totally moving away from it but the amount of capital going into private deals or bank lines is palpable.”

Relative Value: ABS

- BofA analysts believe asset-backeds look cheap compared to short-dated corporates, as the basis between the ICE 1-5 Year AAA-A Corporate Index and the 1+ Year AAA-A US Fixed Rate ABS Index remains well above the pre-pandemic 2-year average

- Within the asset class, the bank likes equipment ABS over prime auto loan bonds, the analysts wrote in their weekly note

- Private student loan ABS also looks attractive compared to FFELP ABS, they said

Quotable

“If CLOs begin to meaningfully underperform the rest of the credit universe, we are prepared to step in as a liquidity provider and increase our allocation, likely alongside an overall increase in gross exposure,” wrote LibreMax Capital co-founder Greg Lippmann in a note seen by Bloomberg.

What’s Next

ABS deals in the queue include Toyota (prime auto loan ABS), Amherst Residential (single-family rental ABS), Hipgnosis (music royalties ABS), American Express (credit card ABS) and GM Financial (prime auto lease ABS).

(Corrects data in deck headline, third paragraph and removes chart to show that esoteric ABS has still increased overall in 2022)

©2022 Bloomberg L.P.