May 14, 2023

Five Key Charts to Watch in Global Commodity Markets This Week

, Bloomberg News

(Bloomberg) -- Grains prices will once again be a central focus in commodities markets this week after the latest talks to extend Ukraine’s safe-export corridor failed to produce a definitive agreement. Meanwhile, European natural gas prices look to end their longest weekly losing streak since early 2020. Here are five notable charts to watch.

Grains Trade

Wheat and corn futures could be poised for a volatile week as uncertainty looms over the future of Black Sea trade from Ukrainian ports. Negotiations to extend a crucial grain-export accord ended in Istanbul last week without a deal, and Russia has threatened to withdraw from the pact by Thursday — 60 days after the last extension — unless its demands over removing obstacles to its own food and fertilizer trade are met. Exports from Ukraine have already slowed significantly due to repeated disruptions to vessel inspections through the crop corridor. Parts of eastern Europe have also set fresh restrictions on Ukrainian imports as they argued the influx was hurting local farmers. Wheat and corn both advanced on Monday.

Natural Gas

The reward US natural gas exporters get for shipping the heating and power-generation fuel into Europe has shrunk to the lowest level since July 2021 amid muted demand. Benchmark European gas futures on Friday commanded a premium of less than $8.15 per million British thermal units over the commodity delivered into the US’s reference hub. That’s down about 91% from August, when European nations were scrambling for supplies of liquefied natural gas to make up for a drop in Russian volumes ahead of winter. US gas shipments have become less attractive at a moment when developers are spending billions of dollars in projects to increase the nation’s export capacity. European gas prices fell for a sixth straight week, the longest losing streak since February 2020, while US futures climbed.

Base Metals

Industry leaders and market participants will convene in Hong Kong at the annual LME Asia Week, the London Metal Exchange’s first in-person gathering in the region since the pandemic struck. China’s uncertain and uneven economic recovery will likely be a hot topic as concerns mount over the demand picture for base metals. The LMEX Index — a gauge for the six main metals traded on the bourse — has tumbled more than 30% since its 2022 peak and recently collapsed below its 200-day moving average, a technical measure closely watched by traders and analysts. Copper futures, which were poised to benefit from China’s reopening from stringent Covid restrictions, have fallen about 8% this quarter. Meanwhile, Chinese imports of the metal dropped to their lowest since October last month.

Diesel

Confidence in European diesel could be waning at the fastest pace ever, after the loss of Russian supply in February failed to result in the shortages that had been feared. Short positions held by hedge funds and money managers have surged in recent weeks as diesel’s premium to Brent collapsed. Weak demand, as well as increased imports into the region from the US and Middle East, have also helped overcome inventory concerns. Active bets against ICE gasoil, Europe’s benchmark diesel contract, in the week ended May 2 expanded by the most since Bloomberg started collating the data in 2011 before retreating slightly in the latest period.

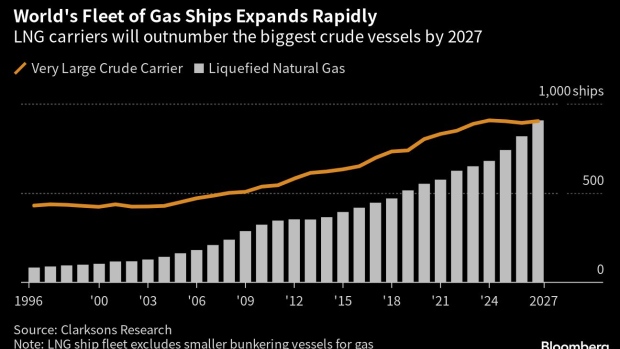

Shipping

Liquefied natural gas ships are forecast to outnumber the biggest tankers used to carry crude oil by 2027. There were 625 LNG ships versus 849 Very Large Crude Carriers — or VLCCs — last year, but this will grow to 907 and 903 respectively, according to Clarksons Research. The investment shift suggests owners are less optimistic about crude demand as they gear up for the world’s transition to less pollutive fuels. Freight rates for oil tankers, however, could stay elevated if the construction of LNG ships are delayed. A fire at South Korea’s Hankuk Carbon in April is already disrupting the production of insulation tanks used to build vessels.

--With assistance from Megan Durisin, Rachel Graham, Ann Koh, Gerson Freitas Jr. and Joe Deaux.

(Updates with wheat and corn trading on Monday in second paragraph.)

©2023 Bloomberg L.P.