Feb 7, 2022

Goldman, Deutsche Bank Year Apart in Israel Rate Hike Calls

, Bloomberg News

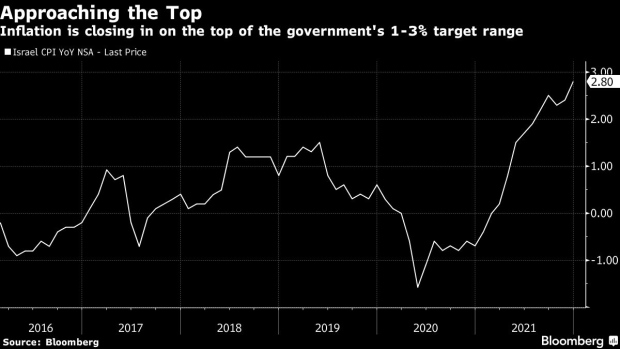

(Bloomberg) -- Some of the world’s biggest investment banks are split over when the Bank of Israel will raise its benchmark interest rate, as inflation grazes the top of the government’s 1-3% target range.

The timing of what would be Israel’s only second rate hike in a decade is so uncertain that Goldman Sachs Group Inc. sees no action until next year. By contrast, Deutsche Bank AG and Citigroup Inc. see rates rising already in the months ahead -- with the German lender predicting two hikes this year.

The divergence stems, in large part, from where they see consumer prices going.

Annual inflation reached 2.8% in December -- a 10-year high but lower than in other developed countries due to factors including the strong shekel, which gained to a 26-year high against the dollar last year before weakening slightly in recent weeks.

Goldman reasons that the shekel’s strength and the Israeli government’s attempts to keep consumer costs down will push inflation below 2% in the second half of the year. Deutsche Bank predicts inflation will cross the government’s 3% target range by February, before dropping off to around 2.2% by the end of the year.

Citi says within-target inflation, combined with a “dovish” rate-setting committee and Covid’s drag on the economy, will likely translate into a “slow pace of rate increases,” beginning in July.

The Bank of Israel research department forecasts rates could be 0.15 percentage points higher by early next year, and has pegged annual 2022 inflation at 1.6%. Its next rate decision is scheduled for Feb. 21.

©2022 Bloomberg L.P.