Aug 14, 2018

Goldman not officially on-board when Tesla’s Musk tweeted

, Bloomberg News

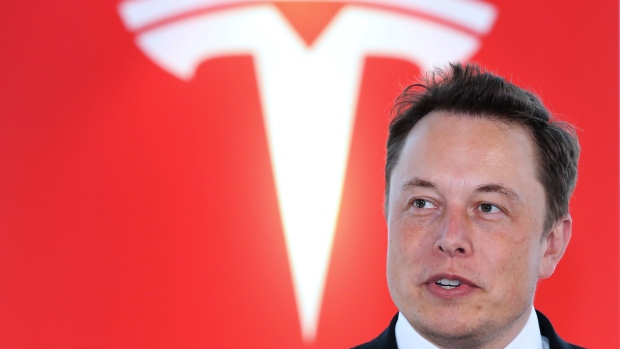

Elon Musk’s announcement about his advisers might be as squishy as his funding.

Goldman Sachs Group Inc. hadn’t been formally tapped as a financial adviser by Tesla Inc.’s chief executive officer when Musk revealed plans last week to take the automaker private and said he’d secured the funding for the transaction, according to people with knowledge of the matter. The bank still hadn’t officially signed on when Musk said on Twitter late Monday that he’s working with Goldman Sachs and private-equity firm Silver Lake as financial advisers, the people said.

Such a statement from a public company CEO typically signals a formal agreement. But Musk has shown a willingness to take an unusual approach, including tweeting last week that he had funding secured for a take-private deal. That declaration has prompted regulatory scrutiny and investor lawsuits.

Read more: Musk’s explanation unlikely to get SEC off his back

Conversations are ongoing between Goldman Sachs and Musk, said the people, asking not to be identified as the information isn’t public.

Informal Advice

Silver Lake appears to be in a similar situation. The technology-focused firm isn’t working for Musk in an official capacity as a financial adviser and isn’t being compensated as a consultant, according to a person with knowledge of the matter. Instead, Tesla’s CEO is hoping to tap Silver Lake’s experience working on some of the biggest take-private transactions -- including Michael Dell’s US$21.7 billion buyout of his namesake computer company and its subsequent US$67 billion acquisition of EMC Corp. -- to help get a deal done, the person said.

Each of those transactions involved the firm making an equity commitment to help fund the deal. While Silver Lake hasn’t committed any financing to Musk’s possible buyout of Tesla, the firm hasn’t ruled out potentially making an investment at some point, the person said.

A spokesman for Goldman Sachs declined to comment. Representatives for Silver Lake and Tesla didn’t respond to requests for comment.

Musk’s latest tweet came just hours after he said Saudi Arabia’s sovereign wealth fund had first approached him about helping take Tesla private early last year, and that the fund’s interest gave him the confidence to state publicly that he was thinking about the move.

“I left the July 31st meeting with no question that a deal with the Saudi sovereign fund could be closed, and that it was just a matter of getting the process moving,” Musk wrote in a blog post Monday.

Tesla’s board is in the process of selecting financial advisers to evaluate Musk’s proposal. It has formed a special committee, according to a statement Tuesday, which will take legal advice from Latham & Watkins LLP and Wilson Sonsini Goodrich & Rosati.