Apr 18, 2022

Hedge Fund BFAM Loses 10% This Year on China Debt, Ruble Trades

, Bloomberg News

(Bloomberg) -- BFAM Partners’ multi-billion dollar multistrategy hedge fund lost another 6.2% in March on China credit and volatility trades, including the ruble, said people with knowledge of the matter.

The March drop extended the first-quarter decline of the BFAM Asian Opportunities Fund to 9.7%, said the people, who asked not to be identified as the information is private. Its assets under management slipped to $3.6 billion, said one of the people.

That represented another setback for what had stood out for years as a star trader in Asia with global ambitions. The Hong Kong-based firm led by former Lehman Brothers Holdings Inc. proprietary trader Benjamin Fuchs in 2021 reported the first annual loss since its mid-2012 inception.

Katarina Royds, who handles investor relations at the firm, declined to comment. The firm oversaw $4.9 billion as recently as August 2021, Bloomberg News previously reported.

BFAM invests in credit, along with equity-linked products such as convertible bonds. It also has trades that seek to profit from swings in stocks, currencies and interest rates, according to a fund document seen by Bloomberg News last year.

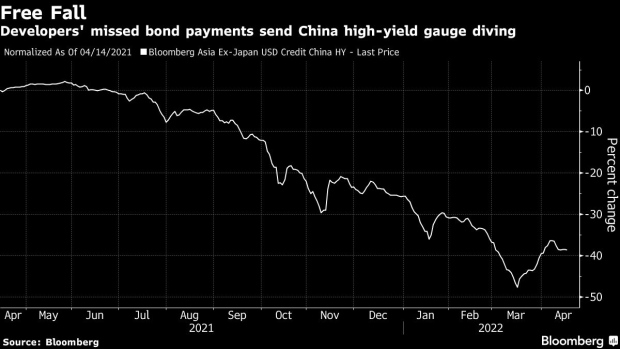

A Bloomberg gauge of dollar-denominated Chinese junk bonds fell another 4.2% in March, as investors dumped notes of property developers after they missed debt payments and an earnings release deadline. Builders had been the most prolific issuers of such debt in previous years. The index has slumped 40% from a May 2021 peak.

Read how Covid is prolonging China’s housing slump

Last year’s sell-off in Chinese high-yield bonds overshot company fundamentals, Fuchs said in an interview with Bloomberg Television on Feb. 10, citing wealth creation and demand for property that remained strong. Still, he said the firm wasn’t yet diving in to buy the dip. The Bloomberg index is little changed this month, as investors weigh signs of support from Chinese policy makers.

A Bloomberg index tracking hedge funds globally retreated 1.2% in the volatile first quarter. Only 26% of Asia-based hedge funds reported positive returns for the three months, according to eVestment data.

The Russian currency is now the most volatile in the world, according to a Bloomberg ranking. The raft of sanctions against Russia for its invasion of Ukraine sent the ruble diving, splitting domestic trading and prices quoted offshore by international banks.

Read a QuickTake on the ruble’s volatility

When trading resumed in Moscow, the currency had effectively devalued by 25% or more in the biggest drop since the 2014 Russian annexation of Crimea. Then Russia’s attempt to force buyers to pay for its oil and gas in rubles sparked a sharp rally back to pre-invasion levels.

©2022 Bloomberg L.P.