Nov 3, 2023

Hedge Funds Cut Bullish Bets on US Oil by Most in Over Two Years

, Bloomberg News

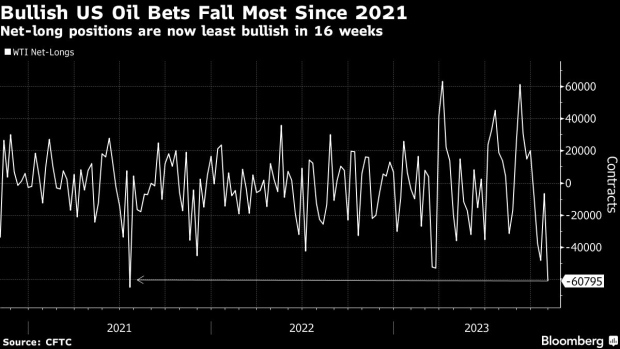

(Bloomberg) -- Hedge funds slashed bullish wagers on US crude by the most since July 2021 as demand angst returned to markets and crude supplies remained unaffected by the Israel-Hamas war.

Net long positions on West Texas Intermediate fell by 60,795 lots to 153,474 in the week ended Oct. 31, weekly CFTC data on futures and options show. That was the least bullish stance in 16 weeks. The speculator group cut their bullish bets on ICE Brent by 16,413 net-long positions to the lowest in three weeks.

The souring sentiment came as oil plunged to the lowest in two months. US crude production is at record highs, and investors are once again focused on demand growth.

©2023 Bloomberg L.P.