Apr 14, 2024

Here Are Five Things China Economists Are Watching to Gauge If Rebound is Real

, Bloomberg News

(Bloomberg) -- The world’s second-largest economy started the year on solid footing, as China’s factories revved up. Analysts warn that growth will be tough to maintain without broader improvement.

A deluge of official data due Tuesday will provide a reality check on whether China’s economy has turned a corner, after a protracted post-pandemic slump. Gross domestic product likely rose 4.8% in the first quarter from a year earlier, according to a Bloomberg survey, bolstering confidence the government could hit its annual goal of about 5%.

Recent bright spots in trade and manufacturing have prompted economists at banks including Goldman Sachs Group Inc. to boost their outlook for 2024. But with exports unexpectedly down in March, and overseas demand largely driving new orders, policymakers still badly need to get people spending at home, according to experts.

“It’s premature to call a sustainable recovery,” said Larry Hu, chief China economist at Macquarie Group Ltd.

Here are five key indicators analysts are watching to track whether China’s first quarter bounce can be sustained:

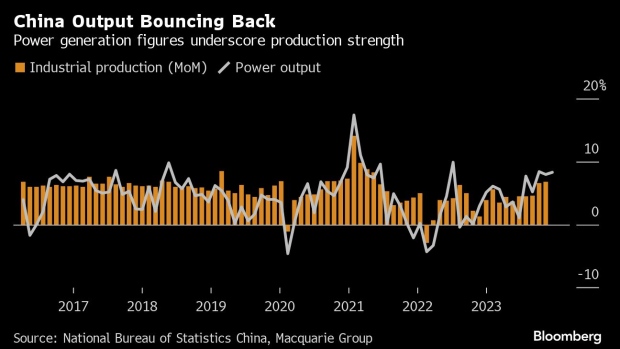

Industrial Production

You’d be hard-pressed to find an economist who doesn’t cite this as a central data point. It measures the total value of output from factories, mines and utilities — in other words, a massive swathe of activity. It rose in the first two months of the year at the fastest pace in two years and analysts forecast a 6% bump in March from the prior year.

A complementary indicator is power production, which tends to be correlated with industrial data, since the sector commands the most power usage, according to Hu. “Economists look for other numbers to confirm or re-check government data on economic growth,” he said.

Power production has been rebounding since China reopened from Covid-related restrictions more than a year ago. Slumping coal prices have made plants more willing to produce and power consumption has improved in recent months.

Home Sales

The stabilization of the property market, where Chinese households have put vast stores of wealth, is central to the nation’s economic recovery: Such a move would boost sentiment, encourage consumer spending and unleash more investment.

That milestone appears far off. Housing sales plunged 33% by value in the January-February period from a year ago, the most since May 2022, and will likely contract again in March. New home sales are watched as a leading indicator for sentiment, investment and prices, said Haibin Zhu, chief China economist at JPMorgan Chase & Co.

“New home sales are still very weak, supporting our view of a third consecutive year of housing activity contraction,” he added. Property investment contraction is also seen worsening in March, despite authorities relaxing rules on buying homes to encourage sales.

Nominal GDP

China’s economy has been in a deflationary funk since last year, with weak wage growth and prices. Last month’s decline in producer prices — a foreshadow of goods yet to hit shelves — indicated more deflationary pressure ahead. Consumer prices are also hovering precariously close to the negative threshold.

That’s why nominal GDP is important, according to Robin Xing, chief China economist at Morgan Stanley. That figure doesn’t adjust for price changes, so it would show the impact of deflation. It also has a higher correlation with corporate profits and revenue growth, he added.

The nominal rate is also used to calculate China’s GDP deflator, the widest measure of prices across the economy. Three quarters of declines last year marked the longest slide since 1999, underscoring the divergence of China’s economy with its biggest rival the US, where hot inflation is proving hard to beat.

Credit Growth

Even if manufacturing looks solid, there’s a distinct lack of confidence in borrowing. New bank loans rose at the slowest pace on record in March suggesting companies and households aren’t buying into the recovery story just yet. Meanwhile, a broad measure of credit expanded at the slowest pace ever, in data going back to 2017.

“The lackluster credit impulse hints at lingering drags on activity,” said Frederic Neumann, chief Asia economist at HSBC Holdings Plc. “A creditless recovery cycle will be difficult to sustain.”

Labor Market

China has another entrenched problem: A weak labor market. The unemployment rate has ticked up in recent months, and many younger workers are still struggling. There are also recent reports of wage freezes and layoffs in some parts of the country. Wages offered to new employees rose in the first quarter after declining at the end of 2023 by the most on record, offering a glimmer of hope for workers.

Higher wages would signal reflation and that “corporates are hiring and investing and the job market is becoming tighter,” said Morgan Stanley’s Xing. That would be “a good sign that China can break out of its deflation loop.”

--With assistance from Fran Wang.

©2024 Bloomberg L.P.