Apr 17, 2024

Investors Hungry for Yield Snap Up 20-Year US Treasuries

, Bloomberg News

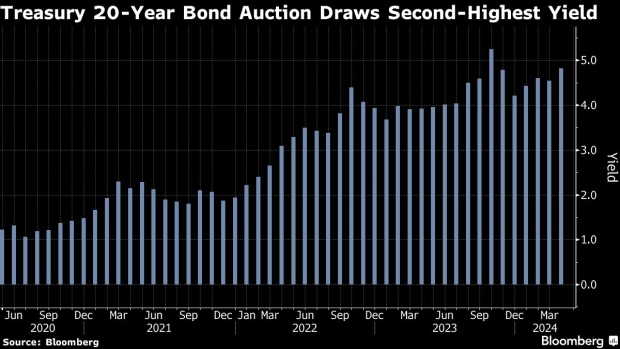

(Bloomberg) -- Investors flocked to Treasury yields near the highest levels of the year on Wednesday, including in an auction of 20-year bonds.

The rally trimmed yields across the market by as much as 10 basis points, suggesting that levels reached this week offer adequate compensation for the risk that growth and inflation trends will forestall Federal Reserve interest-rate cuts.

The 20-year bond auction drew a yield of 4.818%, more than two basis points lower than the bonds’ yield in pre-auction trading shortly before the 1 p.m. New York time bidding deadline — a sign that demand exceeded dealers’ expectations. It was still the second-highest 20-year bond auction result since the tenor was reintroduced in 2020.

“Yields have risen a lot,” said Angelo Manolatos, an interest-rate strategist at Wells Fargo Securities LLC. “Bonds are clearly in demand today, but I don’t think this is a catalyst for a more sustained rally, we’ll need a macro catalyst for that.” The sale also benefited from its relatively small size, he said.

The 20-year yield, which peaked Tuesday at over 4.92%, was around 4.84% at the bidding deadline. It subsequently declined further, to under 4.82%.

Wednesday’s advance lacked a clear fundamental catalyst. Rather, yields had risen to levels where some investors were inclined to buy. Paul Ciana, a technical market analyst at Bank of America Securities, said in a report that the 10-year had “reached our overshoot target level of 4.70%.”

Ciana said the 10-year yield appears to be “in the late stage of an uptrend,” with scope toward last year’s peak at 5.02%, probably by late May. “Then we anticipate buying,” he wrote.

Yields across the Treasury market were spurred to their highest levels of the year this week by stronger-than-expected March retail sales data suggesting that US consumers are coping with elevated interest rates. Earlier this month, job market and inflation indicators were surprisingly strong, sowing anxiety about whether the Fed will deliver on the three quarter-point rate cuts this year that it forecast in March. Derivative contracts and several Wall Street banks no longer anticipate more than one cut this year.

Last week’s Treasury auctions produced weak demand metrics, particularly the 10-year, which drew a yield more than three basis points higher than dealers anticipated.

It was a historically poor result that didn’t bode well for the 20-year, which has struggled to develop a following, as indicated by its higher yield than for the 30-year Treasury despite entailing less risk.

The $13 billion 20-year auction was only a third as large as last week’s 10-year, however. The Treasury Department slashed 20-year auction sizes after a series of sloppy auctions in 2022 revealed a lack of demand for the tenor.

(Adds broader market activity in first paragraph, comments from sixth paragraph. Updates yield levels.)

©2024 Bloomberg L.P.